The Consumer Financial Protection Bureau has dropped its investigation into allegations that Zillow Group Inc. violated Section 8 of the Real Estate Settlement Procedures Act.

Zillow "received a letter from the Bureau stating that it had completed its investigation that it did not intend to take enforcement action," according to an 8-K filing by the company.

The CFPB previously had requested documentation related to a review of

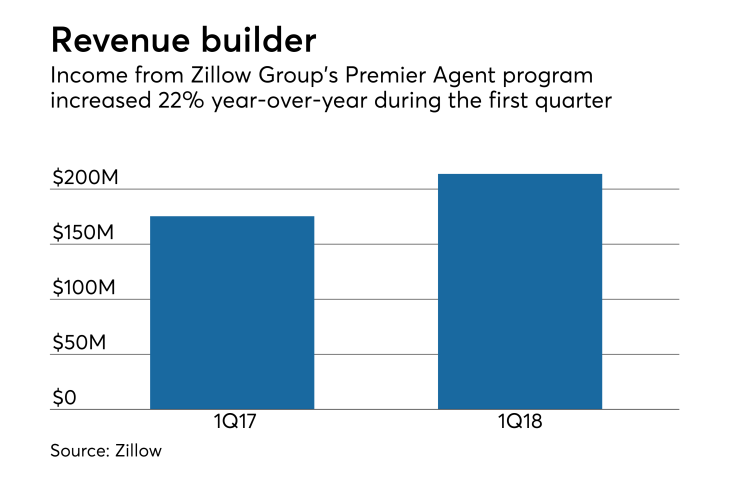

The Premier Agent program that the co-marketing inquiry had been associated with makes up more than 70% of Zillow's revenue. The program traditionally has allowed a premier agent to invite a lender to share up to 50% of online marketing costs with up to five lenders.

Premier Agent revenue "outperformed" in the first quarter, when Zillow was "testing a new lead validation and distribution process" for it, Zillow CEO Spencer Rascoff said in a Seeking Alpha transcript of the company's first-quarter earnings call.

RESPA Section 8 prohibits kickbacks for referrals but allows co-marketing so long as the payment is proportionate to the marketing space allotted.

Co-marketing compliance with RESPA originally was measured based on payment amounts' correlation with the share of physical space a referral gets, but the rise of online "click-throughs" to referral partners has changed the analysis to focus more on how a click-through is configured on a website.