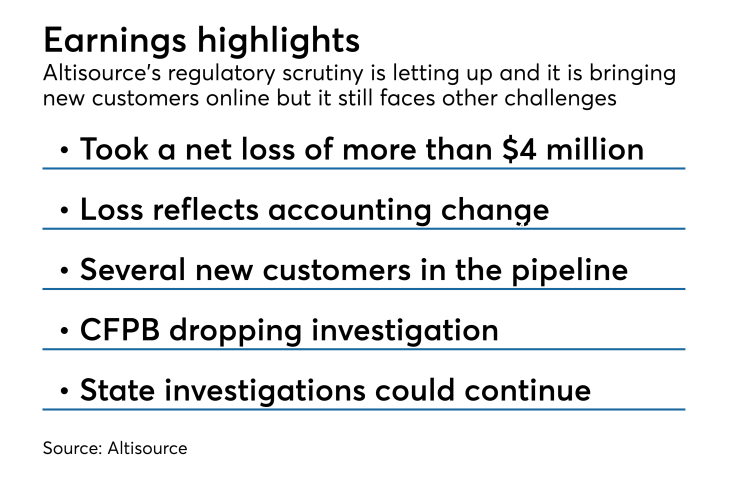

The Consumer Financial Protection Bureau has dropped an investigation into Altisource, a mortgage servicing technology firm with close ties to Ocwen Financial.

The CFPB informed the company that no enforcement action would be taken, Altisource CEO William B. Shepro said in remarks during the Luxembourg-based firm's first-quarter earnings call.

"We received notification from the CFPB that it has completed its investigation, is currently not recommending an enforcement action and relieved us of our document retention obligations pursuant to the civil investigative process," Shepro said.

Altisource disclosed in late 2016 that the CFPB was considering a potential enforcement action related to services it provided to Ocwen Financial. Last year, the CFPB sued Ocwen, a West Palm Beach, Calif., mortgage lender and servicer, alleging that the company illegally foreclosed on 1,000 borrowers who applied for loan modifications and botched basic mortgage servicing functions including sending inaccurate monthly statements to borrowers and mishandling taxes and insurance escrow payments. Ocwen has been

Altisource is a spinoff of Ocwen that was founded by Ocwen's former chairman William Erbey but later became a standalone company. As a standalone company, Altisource has worked to expand its customer base to reduce

Altisource took a more than $4 million net loss in the first quarter, compared with more than $6 million in net income during the same quarter a year ago. The net loss included a more than $7 million (loss than $6 million after-tax) loss related to the effect of an accounting standards change on its investment in Front Yard Residential Corp. stock.

"Our results of operations are in line with our expectations for the seasonally slower first quarter," Shepro said in a press release, noting that during the quarter, the company received notifications that nine servicing and origination prospects would be coming online. "Our robust sales pipeline positions us to accelerate our non-Ocwen sales growth as the year progresses," he said.

Meanwhile, acting CFPB Director Mick Mulvaney has dropped five investigations into payday and installment lenders since President Trump appointed him to lead the consumer bureau in November. Mulvaney also has made plans to have the CFPB to