Originating mortgages for landlords of single-family rental properties could help lenders fill the gap of waning refinance volume.

Single-family homes account for about 60% of the total rental market, with apartment buildings accounting for the remaining inventory, said Rodrigo Lopez, executive chairman of multifamily originator Northmarq Capital, during a residential lending panel at the Regional Conference of Mortgage Bankers Association in Atlantic City, N.J. It's one of many new opportunities lenders are exploring to

Investor property mortgages are generally considered riskier than owner-occupant loans because the borrower is relying on rental income to repay the mortgage. And since it's not the owner's primary residence, a distressed borrower may be more likely to walk away from the property.

Still, a growing number of

There are 8 million to 10 million investors who own between three and four houses and lenders need to take advantage of this business opportunity now that refinancings are declining, said Clayton Holdings President Jeff Tennyson.

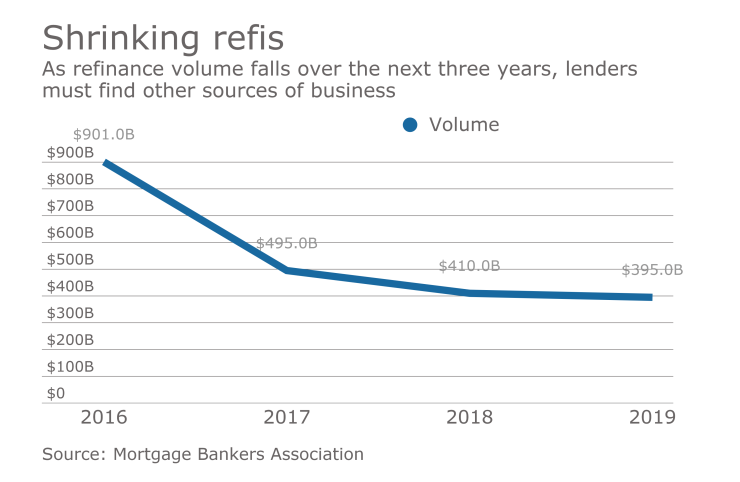

Refinancings are projected to go from $901 billion last year to $496 billion this year, $410 billion in 2018 and $395 billion in 2019, according to the Mortgage Bankers Association.

Millennials are expected to be a new source of business. This group wants to move into homeownership but because of their debt load with student loans and a lack of savings, they need both down payment assistance and low down payment mortgage programs, said Tennyson.

That represents an opportunity for the private mortgage insurers for growth, said Tennyson, whose company is a subsidiary of Radian Group.

But to attract millennial and other consumers from varied backgrounds there needs to be loan officer diversity. "We have to look like the customers we are trying to serve," said Lopez, who is also the chairman of the national MBA.

There are two options for lenders to deal with the lower volumes: downsize or hope to "grow into the downturn" and add market share, said Freedom Mortgage President and CEO Stanley Middleman. That is only possible for companies which have capital, liquidity and a plan in place.

Because overall volume will decline, companies that have a growth strategy "are taking someone else's lunch," Middleman said. So that plan must be realistic, one that "meets their budget not their desire."

In Freedom's case, it has been buying mortgage servicing rights because "we want to have receivable income as that will be valuable in this environment," Middleman said.

It makes sense for Freedom to be aggressive in buying MSRs as it gets the opportunity to add and then keep a customer when that person is looking for their next loan, he said.