Black Knight's second-quarter earnings dropped 20% from the previous year as it took a hit from its indirect investment in Dun & Bradstreet, offsetting a 7% increase in revenue.

The Jacksonville, Fla.-based company had net income of $31.9 million for the period, down from $39.3 million for

"The D&B results reflect, among other things, the incremental amortization related to the application of purchase accounting as well as significant one-time restructuring charges," Chief Financial Officer Kirk Larsen said during the company's conference call.

Revenue rose to $294.9 million, up from $276.6 million for the second quarter of 2018.

Going forward, Black Knight's revenue will be reduced over the next two quarters as the planned exit by a single client that used a noncore platform which was being shuttered took place two quarters earlier than expected. The unnamed client provided $16 million a year in revenue but continued operation of that platform "introduced some unnecessary risk to Black Knight," CEO Anthony Jabbour said on the call. As a result, the company's 2019 revenue is expected to be at the low end of the $1.18 billion to $1.2 billion range it previously expected.

Recently, Black Knight added U.S. Bank's correspondent lending division to its Empower mortgage origination system platform customer roster.

"We signed three Empower Now deals in the second quarter, which brings us to four new clients in the first half of the year. I continue to be confident that we can sign eight to 12 new Empower Now clients this year," Jabbour said.

It also added Triad Financial Services and Fidelity Bank as new clients to its MSP mortgage servicing software system.

"We continue to make progress with implementation," Jabbour said. "In June, we announced that more than

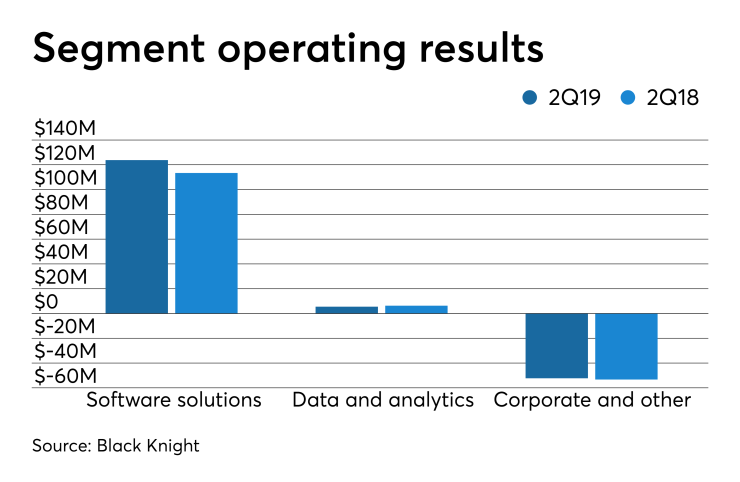

For the quarter, Black Knight's software solutions unit (which covers both Empower and MSP) had operating income of $123.8 million, up from $113.4 million in the same period last year. Data and analytics generated $5.5 million of operating income, down from $6.3 million in the second quarter of 2018, while the corporate and other reporting segment lost $52.3 million, an improvement over the $53.3 million loss a year ago.