Black Knight has staked its space in the growing mortgage wholesale channel with its purchase of a loan origination system for mortgage brokers from NexSpring Financial.

The acquired LOS will be rebranded in the near future, the company said. It will be a standalone platform, although there will be integrations for wholesale mortgage lenders that use Black Knight’s existing product Empower LOS. Terms of the deal were not disclosed.

“Adding a digital lending platform for brokers is a natural progression for Black Knight,” said Rich Gagliano, president of Black Knight Origination Technologies. "Mortgage brokers — and wholesale lending in general — represent the fastest growing origination channel.”

The newly acquired LOS, which has a mobile-friendly application, will also feature integrations with other Black Knight systems including the broker-facing pricing and eligibility engine, Optimal Blue Loansifter.

Earlier this year, Black Knight launched correspondent lending platform

Black Knight has been very active on the acquisitions front. Besides its purchase of Optimal Blue

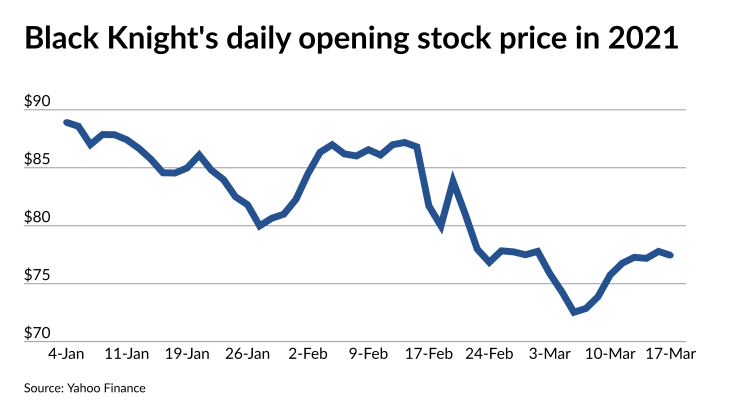

The deal with NexSpring Financial was announced prior to the stock market opening on Wednesday morning. Black Knight started the trading day at $77.46 per share, down $0.53 from Tuesday's close. By 11:30, it had recovered some of that, trading at $77.71 per share.

"Black Knight's culture of investment and innovation makes it the perfect home for what NexSpring initiated," said the Chesterfield, Mo.-based mortgage broker's CEO Mike Fabian in the press release.

Fabian co-founded NexSpring with Rick Thornberry in 2006. Thornberry was the chairman and CEO of both NexSpring Financial and NexSpring Group until he left to become