While Black Knight reported strong fourth-quarter

For the full year of 2021, net earnings attributable to the Jacksonville, Florida-based company came in at $207.9 million, down 21% from $264.1 million in 2020. Operating income for 2021 came in at $303 million and annual revenue of $1.5 billion, up from 2020’s $266.8 million and $1.2 billion respectively.

For the fourth quarter, however, net earnings came in at $60.7 million, up from $53.4 million over

“From a sales perspective, 2021 was a record year and the fourth quarter was the highest of the year,” said Black Knight’s CEO Anthony Jabbour, during the call.

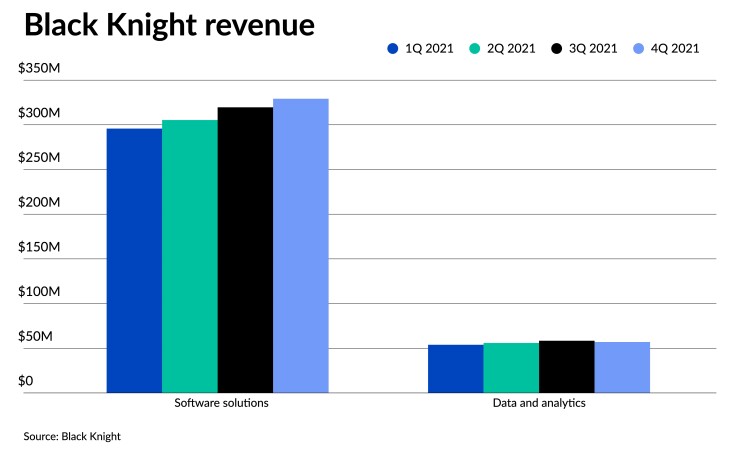

The technology, data and analytics firm posted fourth quarter revenue of $386.2 million, climbing from $378 million in the third quarter and $342.1 million year-over-year, up 2.2% and 13% respectively.

Sales of Empower and MSP, its originations and servicing platforms, drove business for the company, which also had

“For the full year we signed a total of 16 new MSP clients, which is the highest number signed on record and almost double the number of new clients signed in 2020,” Jabbour said. Empower brought in 30 new clients as well, he added.

Meanwhile, the company’s data and analytics services unit accounted for $57 million in revenue and $14.7 million in operating income on a quarterly basis, down from $58.4 million and $17 million in the third quarter, but increasing from $51.3 million and $12.1 million in the final three months of 2020.

Overall, Black Knight brought in $82.9 million in operating income during the fourth quarter while reporting adjusted net earnings of $102.3 million across its entire enterprise.

The company also announced a major leadership transition plan for later this year, as Jabbour steps down from CEO, a role he has held since 2018. Current president Joe Nackashi will replace Jabbour as chief executive officer, while Chief Financial Officer Kirk Larsen will be adding the title of president. Jabbour will move into the position of executive chairman of the board. The appointments are effective in mid May.

Nackashi joined Black Knight 35 years ago, starting at predecessor company Lender Processing Services, where he was executive vice president and chief information officer. Larsen has been chief financial officer at Black Knight since 2014 after serving as corporate executive vice president, finance and treasurer at financial services technology firm FIS. He helped spearhead Black Knight’s initial public offering in 2015 and will take on compliance, human resources and risk management functions as president in addition to his responsibilities as CFO.

Black Knight officials announced as well that it had taken over complete ownership of Optimal Blue PPE,

Organic revenue growth clocked in at 10% on a full-year basis for Black Knight, but is expected to slow in 2022, much of it due to decreased originations leading to less demand for data and analytics products. The past year also saw elevated usage of its MSP software, which they expect to drop slightly.

Larsen said he expected organic growth to fall between 7% and 8%.

“We are planning for a $30 million tailwind and higher foreclosure volumes with the expiration of the moratorium and other measures that precluded most foreclosure starts,” Larsen said. “As it relates to origination volume sensitive revenues, we are planning for an approximately $30 million headwind from lower origination volume, with expected growth in purchase volume to be more than offset by expected lower refinance volumes.“