Black Knight's second quarter net earnings increased approximately 20% on a year-over-year basis, but the negative impact of its investment in Dun & Bradstreet took a big bite out of the results.

The company reported net earnings of $39.1 million, compared with $50.1 million

In the second quarter, the D&B investment reduced net earnings by $31 million, compared

Without the D&B investment and other losses related to unconsolidated affiliates, Black Knight had earnings of $65.1 million, versus $45.3 million one year before.

After the quarter ended, on July 6, D&B's parent company conducted an initial public offering; at the time Black Knight invested $100 million in a concurrent private placement and has since invested an aggregate of $492.6 million in the company.

Black Knight reported higher earnings even with revenue being relatively flat to the prior year period, at $293.1 million compared with $294.9 million.

Its software solutions business, which includes both the industry's most used mortgage loan servicing platform as well as a loan origination system, had a year-over-year drop in both revenue and operating income.

Revenue was $245.1 million, down from $255.4 million in the second quarter of 2019. Expenses also fell, but not by as much, to $98.9 million from $101.5 million.

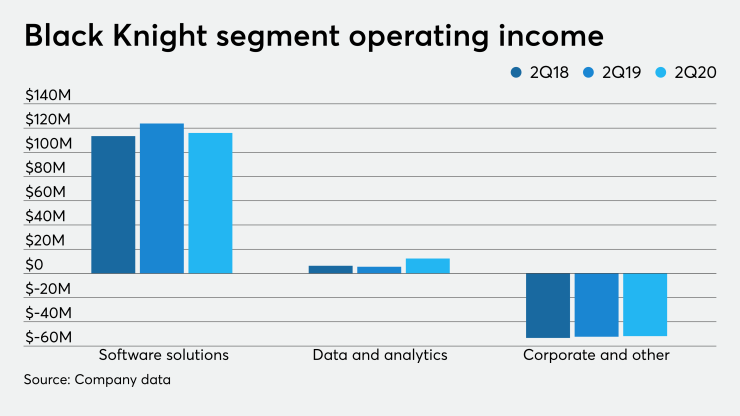

As a result, operating income was $116 million, compared with $123.8 million one year ago.

In particular, servicing software revenue declined 12.5% from a year ago as increased revenues from new and existing clients using its MSP technology were more than offset by the effect of customers leaving and lower foreclosure-related volumes due to the federal coronavirus relief act moratorium.

Origination revenue rose 36% thanks to new clients and higher refinance volume as well as revenue generated from a previous acquisition.

The data and analytics segment on the other hand, saw its operating income more than double during the period to $12.3 million from $5.5 million, as revenue increased by $8.5 million to $48.2 million.

In the second quarter, Black Knight

After the quarter ended it signed an agreement

During Cannae's second quarter earnings call on Aug. 7, Foley said "Logically it would have been great if Black Knight could have acquired the company itself, but it would have really fouled up their debt to [capital] ratios."

Black Knight refined its 2020 outlook from the first quarter, but that new outlook does not include any revenue from Optimal Blue; that will not come until or around the time the deal closes.

It is now expecting revenues in the range of $1.17 billion to $1.184 billion. This is slightly higher than the first quarter guidance of $1.16 billion to $1.18 billion.