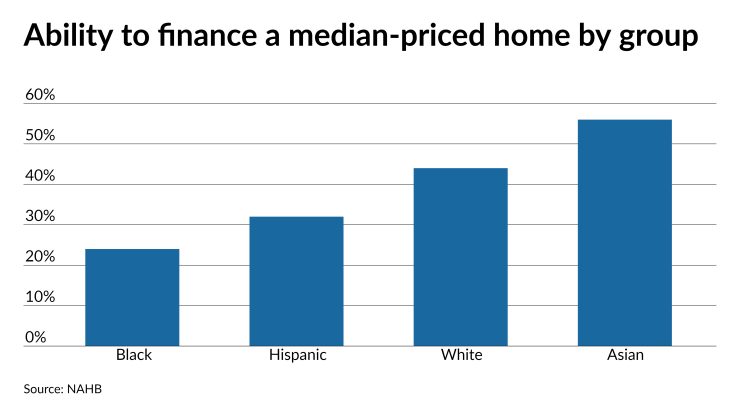

The percentage of would-be borrowers who can meet mortgage underwriting requirements for a new median-priced home is far lower for Black and Hispanic families than it is for white and Asian consumers, a new study finds.

While 56% of Asian households and 44% of white people qualify to finance a new $346,577 home, just 32% of Hispanic consumers and 24% of Black families do, the National Association of Home Builders said in a report released Tuesday.

These disparities pose a challenge to

“[The gaps] are persistent across all states and are in fact larger in states where new home prices are relatively more affordable,” NAHB Senior Economist Na Zhou said in the report.

While new homes represent a smaller part of the U.S. market than resales and tend to be more expensive given

However, with prices rising, newly-built housing is likely to be increasingly out of reach for many borrowers, and particularly those in lower-income brackets. A higher share of these consumers are found in Black and Hispanic communities, the NAHB’s analysis of Census data shows.

While the share of borrowers locked out of the new-home market due to affordability concerns is particularly pronounced for Black and Hispanic borrowers, the number of those being barred by rising home prices is significant for all groups, the NAHB found.

For example, if prices rose by $1,000, it would put financing out of reach for 106,278 white families and 15,840 Black households.

“The number of households being priced out of the market due to a $1,000...increase varies among different racial/ethnical groups but is more or less proportional to population size,” the NAHB economist noted in the report.