Black homeowners recorded the highest growth rate in residential property equity compared with other groups since the start of the pandemic, accelerating a trend in place since 2014, Zillow said.

That helped to narrow the difference between the overall equity for all U.S. homes and those for Black-owned properties to the narrowest point since the turn of the century.

"These gains are extremely important in terms of increasing wealth among the Black community, as homeowners of color are more likely to have the bulk of their household wealth tied up in their homes," said Nicole Bachaud, senior economist at Zillow, in a press release. "Due to years of redlining and other forms of systemic discrimination, housing disparities between Black and white families persist."

A 2021 Zillow study found that even in the most optimistic scenario, in which Black home values grow 15% faster than the overall market and the homeownership grows at 1.5 percentage points per year, it would

The results from this new study provides good news in that the disparity in property values is shrinking and Black homeownership rates are rising, Bachaud added in a follow up statement.

"Home is the most valuable asset, or store of wealth, across the board, but it plays an even larger role in the wealth of Black households," said Bachaud. "But despite the recent gains, we're still a long way from housing equity."

The effects of discrimination from past practices like redlining and the lack of access to financial services, including the number of bank branches in minority neighborhoods, is still being felt, the statement continued.

"As a result, unequal rates of mortgage denials by race are still happening today, making it harder still for BIPOC households to break into homeownership," Bachaud said. "Intentional policies and actions including expanding access to credit, mitigating appraisal bias, providing property tax relief and exemptions and building more affordable homes will be key to achieving housing equity."

A recent study from LendingTree found the share of Black homeowners in each of the nation's 50 largest metro areas was lower than the percentage of Black residents. And

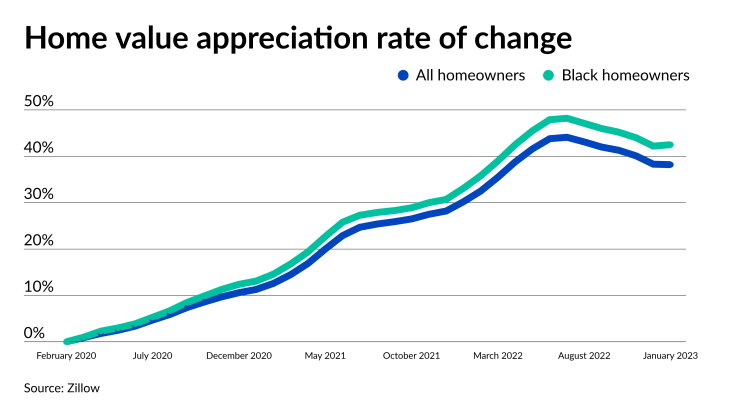

From the start of the pandemic, the typical Black homeowner gained nearly $84,000 in equity. Black home values rose 42.5% from February 2020 through January of this year.

Over the same time period, overall home values grew 38.2%. For white homeowners, this rose by 37.8%, while for Hispanics it grew 38.3% and Asians, 37%.

The Zillow study's time frame covers the recent drop in home values. After peaking in May 2022,

All U.S. homes were worth a total of $45.3 trillion at the end of 2022, down from $47.7 trillion in June, Redfin found.

Back in February 2020, the gap between the value of all homes and one by a Black family was 17.3%. By January that narrowed to 14.8%, the closest it has been since 2000, Zillow said. The calculations are based on Zillow's Home Value Index.

But in the nation's 50 largest metro areas, the gap in values increased in 10 of them, led by San Francisco, up by 3.6%, while two others had no change.

The spread shrunk the most in Detroit, by 9% and Kansas City, Missouri, by 8%.