If the Biden Administration's latest first-time home buyer proposal were to come to fruition, major restrictions regarding eligibility for participation would limit its impact on private mortgage insurers, a Keefe, Bruyette & Woods report said.

Eligibility in the proposal excludes the children of existing or most past homeowners.

"Given these limitations, [the application of this grant] is likely to be narrow," said Bose George, an analyst with KBW, in a report on the draft of the legislation. "We believe this reduces some uncertainty around the potential impact … on the mortgage insurance market since there was some concern in the market that a broad homebuyer tax credit could reduce the need for mortgage insurance."

Because the grant would not make a significant dent into the number of low down payment first-time buyers that would need to turn to credit enhancement to purchase a home, George sees this proposal as a modest positive for the four stand-alone mortgage insurers that he covers: Essent, National MI, MGIC and Radian.

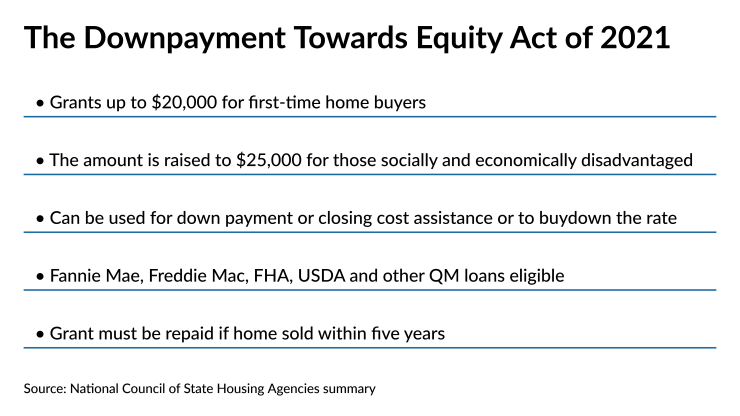

Last week a draft of the Downpayment Toward Equity Act of 2021 became public. It calls for up to a $20,000 grant for first-time buyers, which are defined as those that have not owned a home in the past three years, according to a National Council of State Housing Agencies summary; that is up from

The grant rises to $25,000 for those home buyers the act defines as "socially and economically disadvantaged," including Blacks, Hispanics, Asian Americans and Native Americans according to the draft legislation.

The new initiative would limit the grant to first-generation purchasers — people whose parents were not homeowners during their lifetime or lost their home to foreclosure and currently do not own a home.

The borrower's income cannot exceed 120% of the median for the area. But for high-cost areas, the income limitation is raised to 180%.

Eligible programs include Fannie Mae, Freddie Mac, Federal Housing Administration or U.S. Department of Agriculture or any other loan that meets the qualified mortgage definition. The funds can be used for

Furthermore, the recipient would have to repay the grant in entirety if the property is resold in less than a year as a penalty. Every year, the amount that would have to be repaid is reduced by 20% and after five years, there is no penalty.