A

But appraisal and consumer groups warn that the rule, which increases the loan size at which appraisals become required to $400,000 from $250,000, also could lead to some costly risks that may outweigh the savings.

"The consequences could be substantial," Appraisal Institute President Stephen Wagner said in commentary published by the group.

Loans with an appraisal exemption still need an estimate of the property's market value, but it doesn't have to be prepared by a licensed or certified appraiser. That could lead to valuations that are less accurate, according to the Appraisal Foundation.

"The Appraisal Foundation believes that increasing the appraisal threshold level will negatively affect safety and soundness in real estate lending practices," its president, David Bunton, said in a press release.

However, the American Bankers Association disagrees and calls the use of appraisal alternatives to estimate collateral property values for home loans below $400,000 "consistent with safe and sound banking practices."

Appraisal alternative use is increasing outside the banking industry as well as within it. Those alternatives include the use of

Fannie Mae and Freddie Mac also have

Analysts covering the private securitized market have warned that the practice could

Home prices depreciated severely in the last recession and decimated the performance of private residential mortgage-backed securities.

Some observers blamed the losses on appraisal alternatives like AVMs, and fear the problem could recur if their use increases.

"Shoddy property valuations helped cause one of the biggest financial crises in our nation's history," Andrew Pizor, a staff attorney at the National Consumer Law Center, said in a press release. He called the appraisal final rule "a step backward."

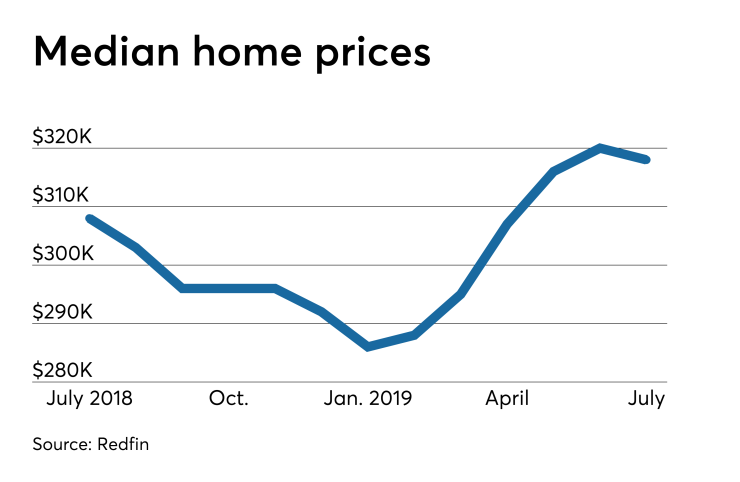

The higher threshold for appraisal requirements means 75% of banks' residential loans will be exempt from appraisal requirements, according to NCLC. The median home price in July was $318,000, according to Redfin.

Home prices in the current market continue to increase, but have decelerated year-over-year