With affordability down to its lowest level in nearly 10 years, average wages aren't enough to afford a home in 75% of local housing markets, according to Attom Data Solutions' Home Affordability report.

Home prices plummeted to their least affordable level since the third quarter of 2008 in this year's first quarter.

The national median home price hit $245,000 in the second quarter, a 4.7% increase from a year ago but down from 7.4% appreciation seen in the prior quarter. The weekly average wage growth was 3.3%, so home prices are appreciating faster than wages.

Some counties where average wage earners could not afford a median-priced home included Los Angeles County, Calif., Cook County, Ill., home to Chicago, and Maricopa County, Ariz., which includes the city of Phoenix.

"Slowing home price appreciation in the second quarter was not enough to counteract an 11% increase in mortgage rates compared to a year ago, resulting in the worst home affordability we've seen in nearly 10 years," Daren Blomquist, senior vice president at Attom, said in a press release.

"Meanwhile, home price appreciation continued to outpace wage growth, speeding up the affordability treadmill for prospective homebuyers even without the rise in mortgage rates," he said.

Attom's affordability index, where a reading below 100 indicates home prices are less affordable than historic averages, fell to 95 in the second quarter, down year-over-year from 103, and month-over-month from 102.

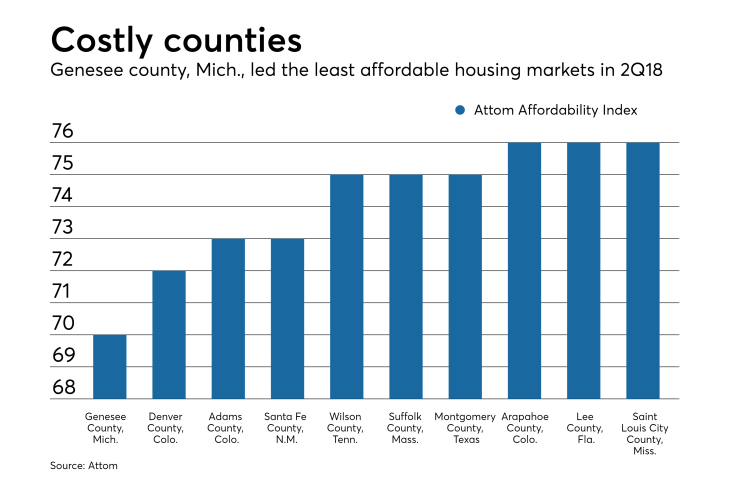

Among counties seeing the lowest affordability indexes in the second quarter were Genesee County, Mich., which includes Flint, Denver County, Colo., and Santa Fe County, N.M.

Homebuyers earning the average income would need to spend 31.2% of their average income to purchase a median-priced home, up from the historic average of 29.6%.

The highest share of income needed to buy a home in the second quarter was in Marin County, Calif., in the Bay Area, where purchasing a median-priced home requires 133.2% of average income.