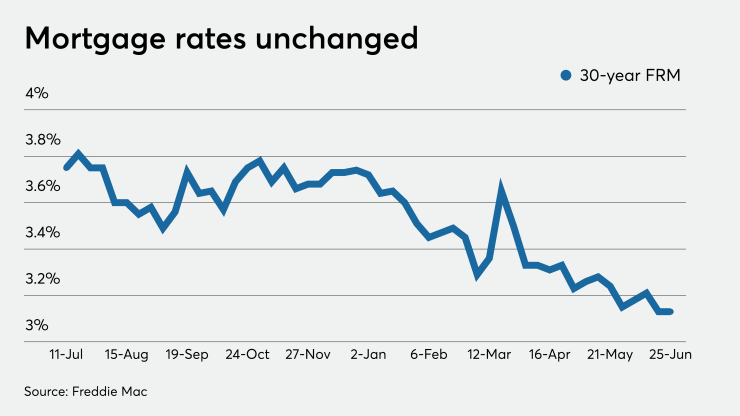

Mortgage rates were flat this week and remain near all-time lows, according to Freddie Mac. But significant numbers of borrowers remain unable to take advantage of them.

"After the Great Recession, it took more than 10 years for purchase demand to rebound to prerecession levels, but in this crisis, it took less than 10 weeks," Sam Khater, Freddie Mac's chief economist, said in a press release. "The rebound in purchase demand partly reflects deferred sales as well as continued interest from prospective buyers looking to take advantage of the low mortgage rate environment."

Zillow's rate tracker was also flat this week as it barely moved over the seven-day period ended Wednesday, staying near all time lows. "However, not all borrowers have access to these historically low rates, as has been the case since the onset of the coronavirus outbreak," said Matthew Speakman, a Zillow economist, in a statement released Wednesday night. "Despite some signs of improvement in many economic sectors, ample uncertainty remains in the market, forcing mortgage lenders to stay on high alert and limit their loan offerings and favorable rates to only the most straightforward lending scenarios."

The 30-year fixed-rate mortgage averaged 3.13% for the week ending June 25, Freddie Mac said,

The 15-year fixed-rate mortgage averaged 2.59%, up slightly from last week when it averaged 2.58%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.16%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.08% percent with an average 0.5 point, down slightly from last week when it averaged 3.09%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.39%.

Where rates head in the short term is largely based on how widespread the latest outbreaks of COVID-19 across the U.S. are and what measures are taken to contain them.

"The recent surge of coronavirus cases in a number of states across the country has only added to the uncertainty, making it increasingly difficult for lenders to price in the appropriate amount of risk and gauge the long-term value of the loan they're issuing," Speakman noted.

"That said, should this increase in COVID-19 case volume continue, mortgage rates would almost certainly fall further to new all-time lows; however, rates would likely rise if states can demonstrate that they have a handle on the virus. For now, a stable week in rates suggests that investors are waiting to react until they see more definitive data."