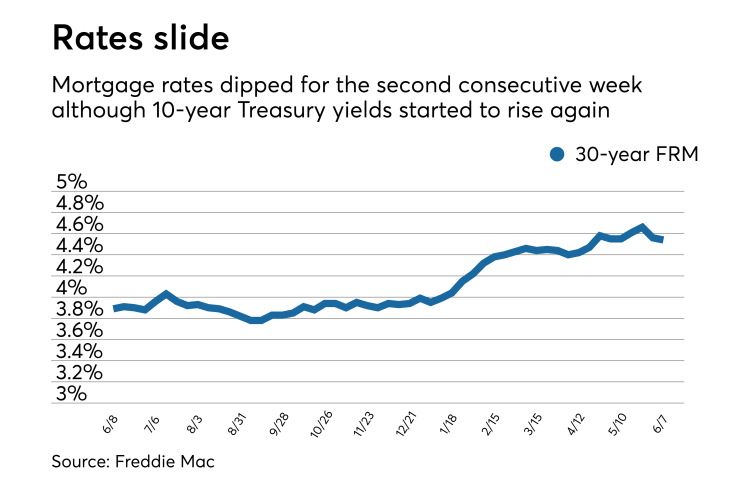

Mortgage rates dipped for the second consecutive week although 10-year Treasury yields started to rise again, according to Freddie Mac.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 4.54% | 4.01% | 3.74% |

| Fees & Points | 0.5 | 0.4 | 0.4 |

| Margin | N/A | N/A | 2.77 |

The 30-year fixed-rate mortgage averaged 4.54% for the week ending June 7,

"Homebuyers have taken advantage of the recent moderation in rates, which led to a 4%

The 15-year fixed-rate mortgage this week averaged 4.01%, down from last week when it averaged 4.06%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.16%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.74% this week with an average 0.4 point, down from last week when it averaged 3.8%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.11%.

The resolution of two political crises in Europe resulted in mortgage rates starting to move back up as investor gained some comfort and slowed their purchases of 10-year Treasury notes, according to Zillow.

"Mortgage rates rose late last week as political uncertainty around elections in Italy and Spain waned," Aaron Terrazas, Zillow's senior economist, said when that company released its own rate tracker on June 6. "With no major announcements or economic data releases this week, financial markets will likely focus on global political news and trade tensions following the recently announced U.S. tariffs on steel and aluminum."