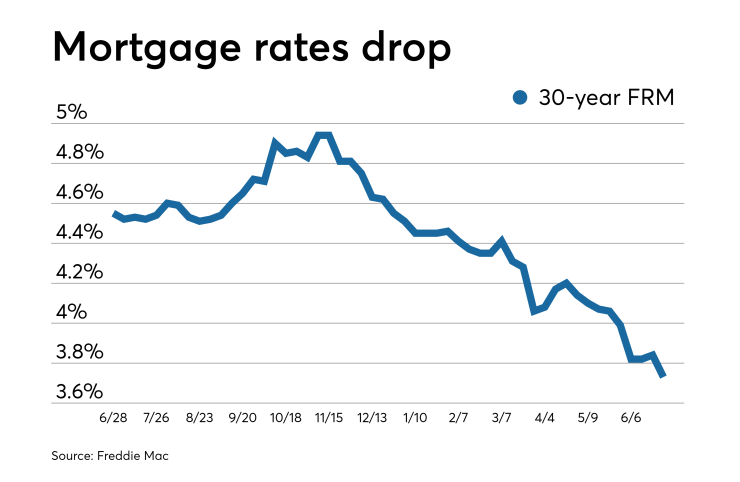

Average mortgage rates dropped for the seventh time in the last nine weeks following news from the Federal Reserve of a possible near-term rate cut, according to Freddie Mac. The 30-year fixed-rate mortgage fell to 3.73%, its lowest level since November 2016.

| | 30-Year FRM | 15-Year FRM | 5/1-Year ARM |

Average Rates | 3.73% | 3.16% | 3.39% |

Fees & Points | 0.5 | 0.5 | 0.4 |

Margin | N/A | N/A | 2.75 |

"While the industrial and trade related economic data continues to dominate the news, the drop in mortgage rates over the last two months is already being felt in the housing market," said Freddie Mac Chief Economist Sam Khater in a press release. "Through late June, home purchase applications improved by five percentage points compared to the previous month. In the near-term, we expect the housing market to continue to improve from both a sales and price perspective."

The 30-year FRM is down from 3.84% from

"Rates have fallen consistently over the past several weeks, and that trend continued in the days following the Fed’s suggestion of a near-term cut to the federal funds rate. Since then, however, rates have remained mostly level as strong equity market performance was balanced out by lukewarm economic data. Tuesday’s disappointing release of consumer confidence figures — the lowest reading in nearly two years — pushed treasury yields down, and mortgage rates followed suit," said Speakman.

"Ultimately, mortgage rates remain near their lowest levels since 2016 after an action-packed couple of weeks, but it is unlikely that rates will fall much further despite the recent dose of disappointing data. Looking ahead, the risk to rates is to the upside. Markets are increasingly confident that this week’s G-20 summit will yield a trade agreement between the U.S. and China, something that many believe will boost spending and support global economic activity," he continued.

The 15-year FRM averaged 3.16% for the week ending June 27, a decline from last week's 3.25% and last year's 4.04%, Freddie Mac reported.

The five-year Treasury-indexed hybrid adjustable-rate mortgage declined to 3.39% from 3.48% and 3.87% on a weekly and annual basis, respectively.