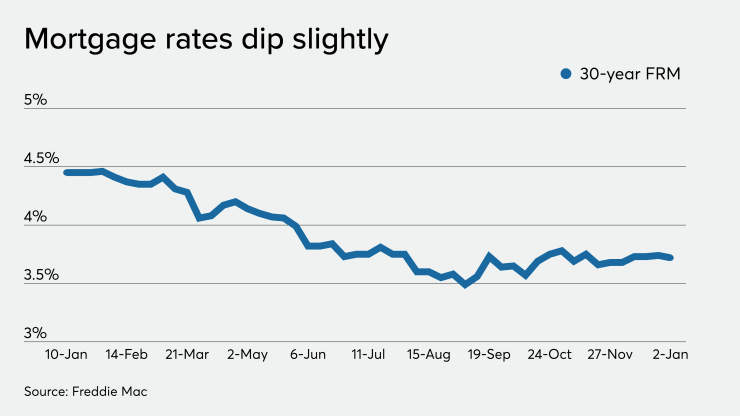

If the first weekly Freddie Mac report of the year is any indication, there could be far less volatility for fixed mortgage rates in 2020 than there was in 2019.

The average rate for the 30-year fixed rate mortgage remained largely unchanged during the week ending Jan. 2, when it inched down 2 basis points to 3.72% from

“The combination of improved economic data and market sentiment has led to stability in mortgage rates, which have hovered around 3.7% for nearly the last two months,” Freddie Mac Chief Economist Sam Khater said in a press release. “The stability is welcome news after the interest rate turbulence of the last year.”

In December, Khater predicted that the 30-year fixed rate would average 3.8% for each

The average rate for a 15-year fixed rate mortgage also was down slightly from the previous week and considerably from a year ago. That rate fell 3 basis points from the previous week to 3.16%; it was nearly 4% during the first week of January last year.

The average rate for the five-year Treasury-indexed adjustable-rate mortgage rose by a basis point from the previous week to 3.46%, but it was down more than 0.5% from a year ago, when it was 3.98%.

Average commitment rates were as follows: 0.3 of a point for five-year hybrid ARMs and 0.7 of a point for 15- and 30-year fixed-rate mortgages. This was unchanged from the previous week. A year ago, commitment rates averaged 0.5 of a point for fixed-rate mortgages, and 0.4 of a point for five-year Treasury ARMs.