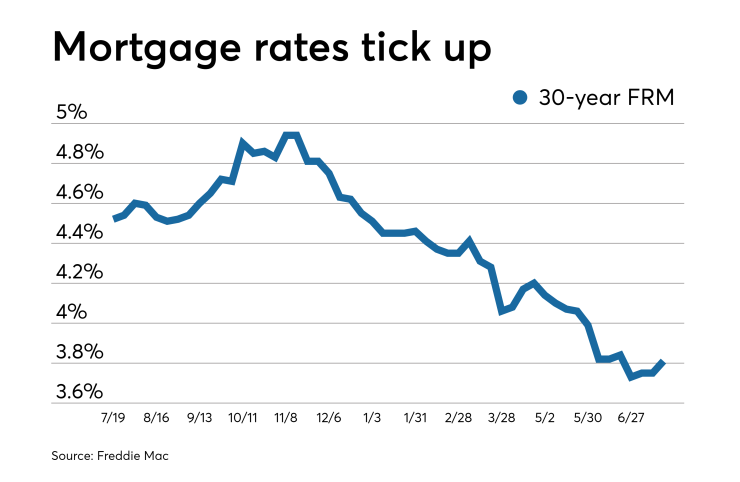

After three weeks of holding fairly steady, average mortgage rates ticked up this week, ironically due to investor optimism that the Federal Open Market Committee will cut short-term rates, according to Freddie Mac.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 3.81% | 3.23% | 3.48% |

| Fees & Points | 0.6 | 0.5 | 0.4 |

| Margin | N/A | N/A | 2.74 |

"Mortgage rates moved higher after remaining at around the same level for about three weeks. The rise in rates was driven by continued improvement in consumer spending and partly due to optimism around a forthcoming cut in short-term interest rates, which should provide support for business and investor sentiment," Sam Khater, Freddie Mac's chief economist, said in a press release.

"Despite this slight increase in rates, homebuyers are taking advantage of the multiyear low rates in droves, which is evident in the consistently higher refinance and purchase application volumes. The improvement in housing demand should provide sufficient momentum for the housing market and economy during the rest of the year."

The 30-year fixed-rate mortgage averaged 3.81% for the week ending July 18,

The 15-year fixed-rate mortgage averaged 3.23%, up from last week when it averaged 3.22%. A year ago at this time, the 15-year fixed-rate mortgage averaged 4%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.48% with an average 0.4 point, up from last week when it averaged 3.46%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.87%.

In its tracker, Zillow noted that mortgage rates did not rise as much as they could have.

"Despite strong economic releases, unexpectedly weak home construction data and concerns about international trade relations tempered mortgage rate increases over the past seven days," Matthew Speakman, an economic analyst at Zillow, said in a press release.

"Demand for Treasurys eased as the Core Consumer Price Index — a key measure of inflation which posted its stronger increase in 18 months — and retail sales figures beat what the market anticipated. Generally, rates have held strong through a stretch that could have resulted in upward movements, but with more housing data on tap for next week, rates aren't off the hook yet."