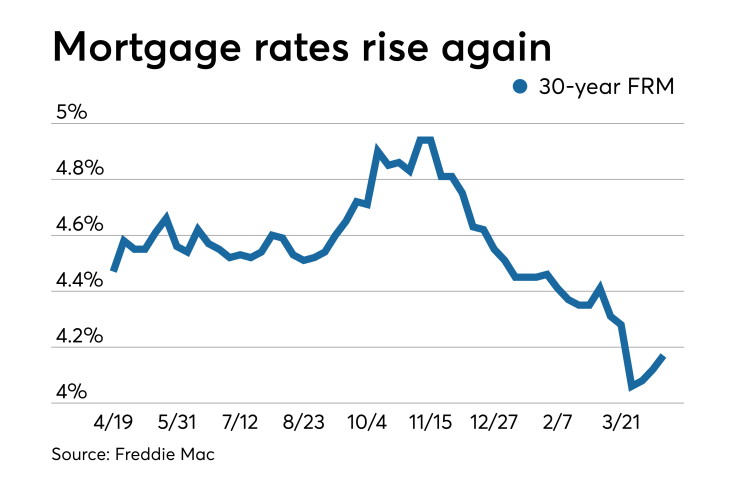

Mortgage rates rose for the third consecutive week, but home purchases are up as well, to their highest level in nine years, according to Freddie Mac.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 4.17% | 3.62% | 3.78% |

| Fees & Points | 0.5 | 0.5 | 0.3 |

| Margin | N/A | N/A | 2.74 |

The 30-year fixed-rate mortgage averaged 4.17% for the week ending April 18,

"After dropping dramatically in late March, mortgage rates have modestly increased since then. While this week marks the third consecutive week of rises, purchase activity reached a nine-year high — indicative of a strong spring home buying season," Sam Khater, Freddie Mac's chief economist, said in a press release.

The 15-year fixed-rate mortgage this week averaged 3.62%, up from last week when it averaged 3.6%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.94%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.78% with an average 0.3 point, down from last week when it averaged 3.8%. A year ago at this time, the five-year adjustable-rate mortgage adjustable-rate mortgage averaged 3.67%.

Weak data and concerns over slowing growth in China and Europe helped to drive down bond yields along with mortgage rates in the past few months, but investors changed course following recent news that showed encouraging economic trends. "Should favorable reports continue to roll in from overseas, additional modest rate increases would likely follow," Matthew Speakman, an economic analyst at Zillow, said when that company released its rate tracker.

"However, rates are still well below the recent high-water mark they reached in the fall, and without evidence of a meaningful uptick in U.S. inflation, it is unlikely that mortgage rates will see any substantial increases anytime soon. Looking ahead, the markets' focus is sure to shift back to home soil, as important retail sales figures and a slew of housing data are on tap over the next few days."