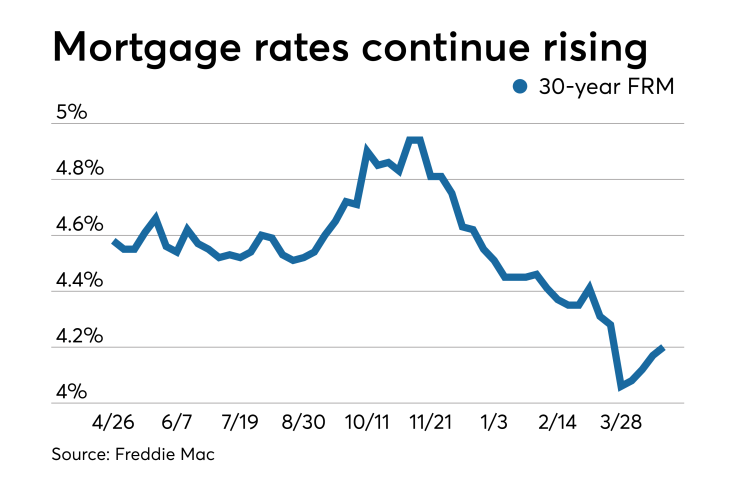

Mortgage rates posted a fourth consecutive week of increases, but Freddie Mac remains bullish in its outlook for this spring's home purchase season.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 4.20% | 3.64% | 3.77% |

| Fees & Points | 0.5 | 0.5 | 0.4 |

| Margin | N/A | N/A | 2.77 |

The 30-year fixed-rate mortgage averaged 4.2% for the week ending April 25,

"Despite the recent rise in mortgage rates, both existing and new home sales continue to show strength — indicating the lagged effect of lower rates on housing demand," Sam Khater, Freddie Mac's chief economist, said in a press release. "This, along with improved affordability, should push housing activity higher in the coming months."

The 15-year fixed-rate mortgage this week averaged 3.64%, up from last week when it averaged 3.62%. A year ago at this time, the 15-year fixed-rate mortgage averaged 4.02%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.77% with an average 0.4 point, down from last week when it averaged 3.78%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.74%.

"Economic uncertainty has been subsiding in recent weeks, which, in general, is applying upward pressure on rates," Matthew Speakman, an economic analyst at Zillow, said when that company released its rate tracker.

"Looking ahead, the pace of economic data releases picks up significantly in the coming days, beginning with April 26's initial reading of the first quarter gross domestic product and continuing into next week with inflation figures and April's Federal Open Market Committee meeting. While a federal funds rate hike, and sharp mortgage rate increases,