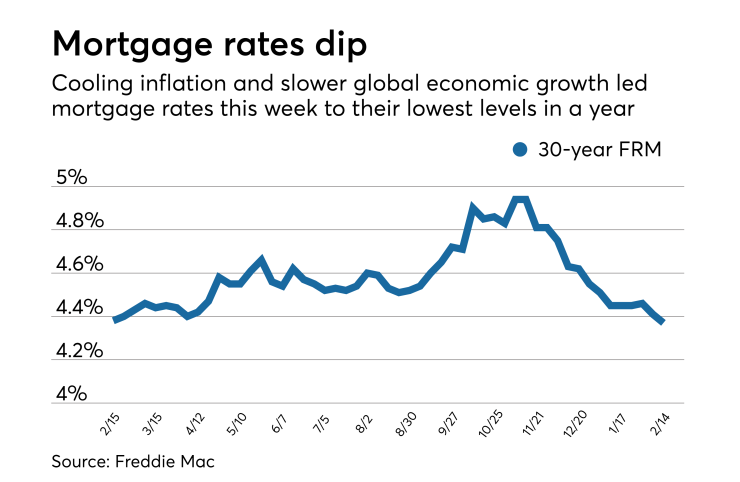

Mortgages rates fell to their lowest levels since early 2018, but positive news involving trade and no new shutdown could send them rising again, according to Freddie Mac.

| 30-Year FRM | 15-Year ARM | 5/1-Year ARM | |

| Average Rates | 4.37% | 3.81% | 3.88% |

| Fees & Points | 0.4 | 0.4 | 0.3 |

| Margin | N/A | N/A | 2.77 |

The 30-year fixed-rate mortgage averaged 4.37% for the week ending Feb. 14,

"The combination of cooling inflation and slower global economic growth led mortgage rates to drift down to the lowest levels in a year. While housing activity has clearly softened over the last nine months and the lingering effects of higher rates from last year are still being felt, lower mortgage rates and a strong job market should rekindle demand for the spring home buying season," Sam Khater, Freddie Mac's chief economist, said in a press release.

The 15-year fixed-rate mortgage this week averaged 3.81%, down from last week when it averaged 3.84%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.84%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.88% with an average 0.3 point, down from last week when it averaged 3.91%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.63%.

"Mortgage rates were mostly flat again this week, but could start to climb now that it appears that Congress and the president have agreed to a budget deal to avoid another partial federal government shutdown and news of progress in trade talks between the U.S. and China," said Aaron Terrazas, senior economist at Zillow.

"Rates spent the earlier part of the week hovering near one-year lows, but began to drift higher as early reports of a tentative budget deal began to trickle in. Wednesday's strong inflation data pushed up bond yields, as inflation has been one of the main indicators Fed officials are watching to evaluate the health of the U.S. economy. Over the coming week, markets are likely to keep an eye on incoming retail sales and consumer sentiment data, which should bring into focus how American consumers fared during January's government shutdown," Terrazas said.