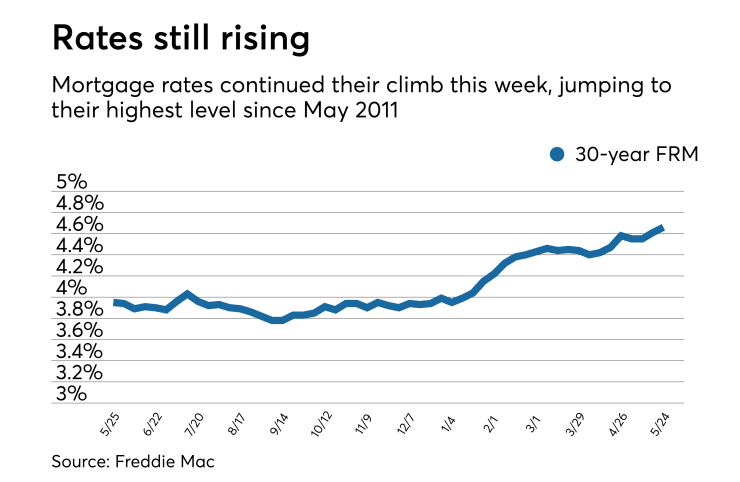

Mortgage rates continued their climb this week, jumping 5 basis points to their highest level since May 2011, according to Freddie Mac.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 4.66% | 4.15% | 3.87% |

| Fees & Points | 0.4 | 0.4 | 0.3 |

| Margin | N/A | N/A | 2.77 |

The 30-year fixed-rate mortgage averaged 4.66% for the week ending May 24,

"Mortgage rates so far in 2018 have had the most sustained increase to start the year in over 40 years. Through May, rates have risen in 15 out of the first 21 weeks, which is the highest share since Freddie Mac began tracking this data for a full year in 1972," Sam Khater, Freddie Mac's chief economist, said in a press release.

"At a time when housing inventory remains extremely low, it's worth watching whether these higher borrowing costs lead some would-be sellers to stay put in their current home. Inventory shortages would likely worsen if more homeowners decide not to sell out of reluctance of having a new mortgage with a higher rate."

The 15-year fixed-rate mortgage this week averaged 4.15%, up from last week when it averaged 4.08%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.19%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.87% this week with an average 0.3 point, up from last week when it averaged 3.82%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.07%.

With the upcoming Memorial Day holiday, things are likely to stabilize in the short term but that could change by the end of next week.

"Absent any geopolitical surprises, financial markets should be quiet going into the long holiday weekend, but expect more movement next week leading up to next Friday's jobs report," Aaron Terrazas, Zillow's senior economist, said when that company released its own rate tracker on May 23.