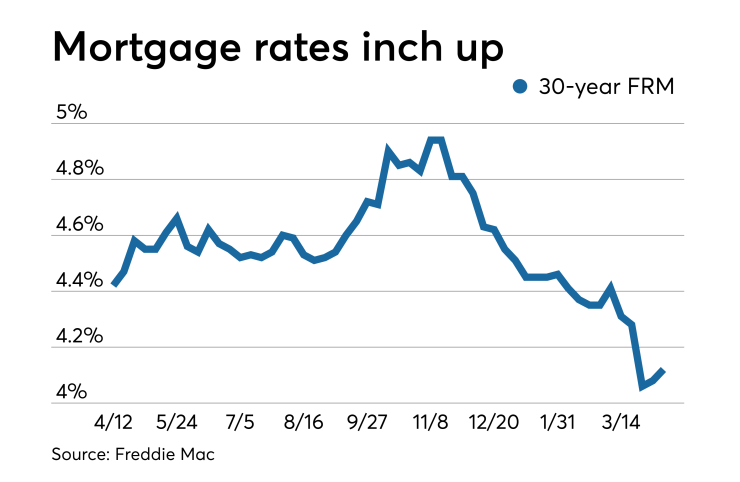

Mortgage rates rose slightly for the second consecutive week, but should remain low for the foreseeable future, which will aid the purchase market, according to Freddie Mac.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 4.12% | 3.60% | 3.80% |

| Fees & Points | 0.5 | 0.4 | 0.4 |

| Margin | N/A | N/A | 2.75 |

The 30-year fixed-rate mortgage averaged 4.12% for the week ending April 11,

"Rates moved up slightly this week while

The 15-year fixed-rate mortgage this week averaged 3.6%, up from last week when it averaged 3.56%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.87%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.8% with an average 0.4 point, up from last week when it averaged 3.66%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.61%.

Investors interpreted the slowing of wage growth in the

The April 10 release of the minutes from the Federal Open Market Committee's March meeting confirmed that it is unlikely to increase short-term interest rates during 2019. "Low-price growth was an important contributor to the Fed's dovish policy adjustment last month, and many investors believe that without the threat of a meaningful uptick in inflation it is highly unlikely that bond yields, and mortgage rates, will increase a significant amount," Speakman said.