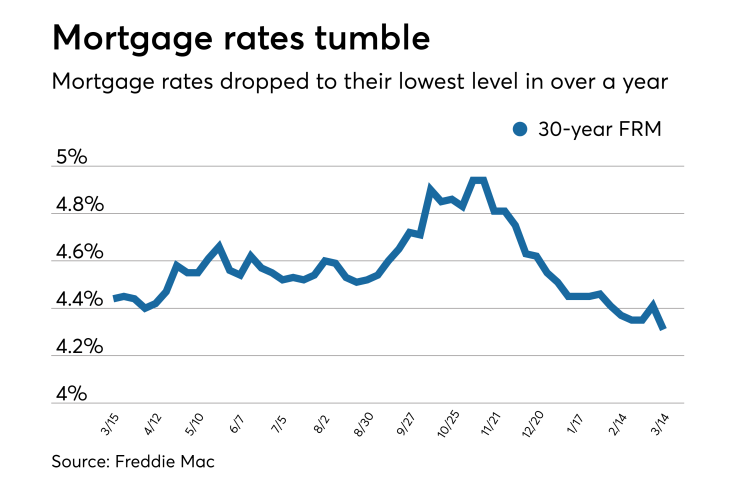

Mortgage rates declined across the board this week, which should make home buying more attractive although there are continuing concerns about inventory, according to Freddie Mac.

| 30-Year FRM | 15-Year ARM | 5/1-Year ARM | |

| Average Rates | 4.31% | 3.76% | 3.84% |

| Fees & Points | 0.4 | 0.4 | 0.3 |

| Margin | N/A | N/A | 2.75 |

The 30-year fixed-rate mortgage averaged 4.31% for the week ending March 14,

"Mortgage rates declined decisively this week amid various market reports, a strong bond auction and further uncertainty around the Brexit deal, which all contributed to driving bond yields lower," said Freddie Mac Chief Economist Sam Khater in a press release. "At 4.31%, the average 30-year fixed mortgage rate is at its lowest since February of last year. While these low rates will certainly get the attention of prospective homebuyers, the

The 15-year fixed-rate mortgage this week averaged 3.76%, down from last week when it averaged 3.83%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.9%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.84% with an average 0.3 point, down from last week when it averaged 3.87%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.67%.

"Economic data, particularly U.S. inflation figures released Tuesday, also contributed to declining rates," Matthew Speakman, an economic analyst at Zillow, said when that company released its rate tracker.

"Consumer price levels — one of the main indicators Fed officials are watching to evaluate the health of the U.S. economy — increased in February, but at a pace that fell short of analysts' expectations. This, coming on the heels of