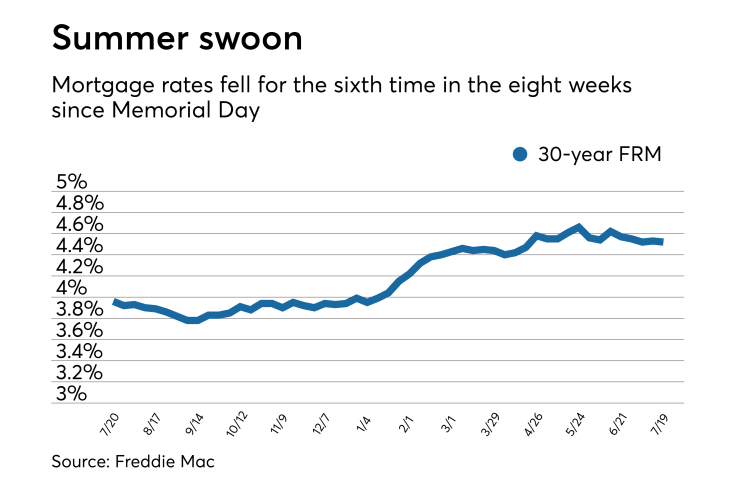

Varied economic data caused mortgage rates to take a small step down, decreasing for the sixth time in the eight weeks since Memorial Day, according to Freddie Mac.

| | 30-Year FRM | 15-Year FRM | 5/1-Year ARM |

Average Rates | 4.52% | 4.00% | 3.87% |

Fees & Points | 0.4 | 0.4 | 0.3 |

Margin | N/A | N/A | 2.76 |

"Manufacturing output and consumer spending showed improvements, but construction activity was a disappointment," Freddie Mac Chief Economist Sam Khater said in a press release. "This meant there was no driving force to move mortgage rates in any meaningful way, which has been the theme in the last two months. That's good news for price-sensitive home shoppers, given that this stability in borrowing costs allows them a little extra time to find the right home."

The 30-year fixed-rate mortgage averaged 4.52% for the week ending July 19,

Yields on the 10-year Treasury note, a key indicator in pricing 30-year fixed-rate mortgages, continued moving sideways around the same level.

The 15-year fixed-rate mortgage also fell this week and averaged 4%, down from last week's 4.02%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.23%.

The average five-year Treasury-indexed hybrid adjustable-rate mortgage was the only of the three to increase. This week's average was 3.87% up from 3.86% a week ago. The five-year adjustable-rate mortgage averaged 3.21% at this time last year.

"Mortgage rates trended slightly lower over the past week, and are well below their recent highs reported in mid-May. The decline was likely driven by geopolitical concerns, as incoming data, including inflation and retail sales, as well as comments from Federal Reserve officials all point to higher rates," Aaron Terrazas, Zillow's senior economist, said when that company released its own rate tracker on July 18.