The percentage of borrowers who have asked to temporarily suspend payments due to coronavirus-related hardships is down overall, but in the Ginnie Mae market, they're still inching up.

The overall share of loans in forbearance dropped 8 basis points to 6.93% from 7.01%, according to the Mortgage Bankers Association's weekly report for Sept. 7-13.

However, within the universe of securitized loans insured by Ginnie, there was a 3-basis-point increase to 9.15% from 9.12%.

In comparison, the share of loans in forbearance in the government-sponsored enterprise market fell 10 basis points to 4.55% from 4.65%. In the private market for portfolio loans and residential mortgage-backed securities, the percentage dropped 19 basis points to 10.52% from 10.71%.

Ginnie Mae's increasing share of forbearance reflects a slowdown in the job market's recovery, MBA Chief Economist Mike Fratantoni noted in the report. That slowdown has had a disproportionate impact on the Ginnie Mae market's low- and moderate-income borrowers.

Under the terms of the CARES Act, borrowers with government-related loans can put their payments on hold for six months, with a one-time extension for another six months if needed. They must later repay the amount forborne.

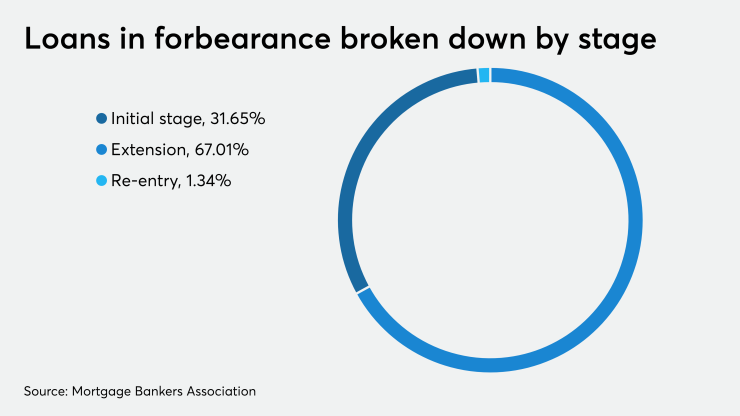

Loans in forbearance tracked in the latest MBA survey broke down as follows: 67.01% were in extended plans, 31.65% were in the initial forbearance stage, and the remaining 1.34% represented loans that had exited forbearance, but then re-entered it.

Monthly advances servicers are responsible for advancing to investors due to forbearance total $6.1 billion, according to estimates industry vendor Black Knight extrapolated from its McDash Flash data set last Friday. That total breaks down into $4.5 billion in principal and interest, and $1.6 billion in taxes and insurance.

The industry has obtained limited relief from its responsibility for servicing advances from government intervention, such as monetary policy stimulus that has fueled strong origination activity. But servicers remain concerned about having to temporarily cover payments borrowers aren't making.