Mortgage servicing is going through a transition.

While defaults and delinquencies are

Banks, which have long dominated servicing, are increasingly retreating from the sector. And the market participants taking their place are rethinking how business is done. That's led to increased division between the entities that hold mortgage servicing rights and the entities that actually handle the servicing work.

Now, as interest rates begin to rise, the nonbanks and capital markets investors pursuing these strategies may soon be presented with unprecedented growth opportunities.

But their success will be determined by how they identify and respond to an increasingly complex risk profile that exists in servicing. So mortgage lenders, servicers and investors all must reassess their roles in the servicing market and find the best strategic position to maximize their strengths.

Increased costs, for example, have intensified the pressure on nonbank lenders to raise cash by buying or securing financing against their servicing rights when rate-driven declines in production start cutting into profits. To do this, nonbanks are increasingly turning to capital markets for liquidity.

The capital markets have started to respond by showing more interest in MSR purchases and financing, but there are questions about whether their appetite for the asset is sustainable long-term.

At the same time, new capital requirements for MSRs have made banks think twice about how much involvement they want to have in the servicing business.

Those considerations mean retaining servicing as a natural hedge against declining origination volume, as conventional wisdom in the industry would recommend, is no longer a given.

Could that ever change? With a presidential administration that's more inclined toward deregulation now in charge, mortgage servicing could once again become an attractive business for banks.

However, there's no near-term plan to rollback these compliance requirements. In the meantime, banks, nonbanks and investors continue to pursue their respective strategies, while remaining nimble to respond to new developments.

Bank exodus

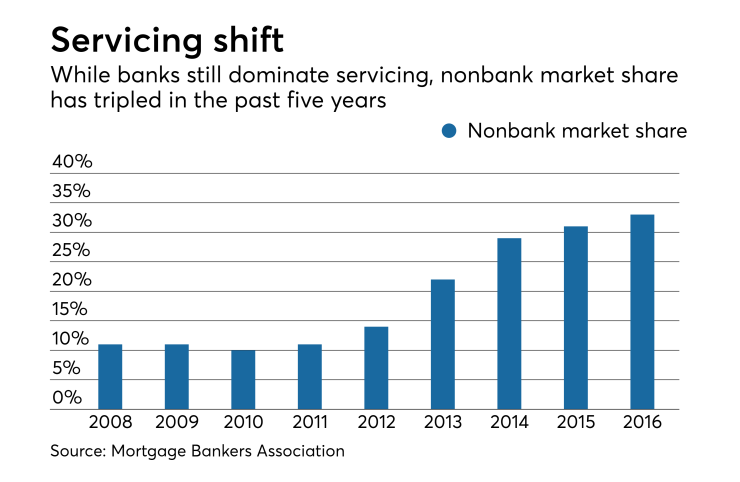

Banks continue to dominate mortgage servicing, but their 67% share of the market at the end of 2016 marks a decline from levels just below 90% between 2008 and 2011, Mortgage Bankers Association statistics show.

It's long been the rule of thumb for mortgage companies to hold onto servicing rights when interest rates are rising; as the additional revenue helps offset declines in originations, particularly refinances. But as rates slowly begin to creep up, that convention may no longer apply — at least not for banks.

The increased operational complexity and regulatory scrutiny around servicing has created unique challenges for banks. That's because banks manage mortgages as part of a broader array of financial services. They have less of an appetite for complexities than nonbank servicers, which tend to be more focused specialists.

"There's really an opportunity for us to participate in this space more."

— Stan Middleman, CEO, Freedom Mortgage

In addition, stricter Basel III capital requirements for mortgage servicing rights and other rules have made it more difficult for banks to leverage their balance sheets in their MSR strategies, something nonbanks don't have to worry about.

"There's really an opportunity for us to participate in this space more," said Stan Middleman, CEO of nonbank lender and servicer Freedom Mortgage.

But nonbanks have their own unique challenges, particularly when it comes to having enough liquid capital to maintain a robust servicing operation. As a result, a new model has emerged in which capital markets investors acquire MSR portfolios and outsource the work of actually managing the mortgage accounts to subservicers, often nonbank servicers.

The number of capital markets participants pursuing this strategy is still small. But they're quickly amassing a significant share of MSRs that may serve as a proof of concept for two entities to work together to shoulder the workload and share in the profits of the servicing activities that banks used to do by themselves.

New Residential Investment Corp. is the poster child for these efforts. The real estate investment trust was created by Fortress Investment Group, the same private equity firm that manages nonbank lender and servicer Nationstar Mortgage Holdings.

"There's an opportunity for entities like [New Residential] that want to acquire MSRs but don't really have the infrastructure to service. So you may see some of that," said Bill Fricke, a vice president and senior credit officer at Moody's Investors Service.

Earlier this year, New Residential agreed to acquire the vast majority of

As a REIT, New Residential enjoys tax benefits that make it cheaper to raise funds to acquire MSRs. For Nationstar, the addition of the Citi portfolio helps it add scale to its servicing platform without devoting financial resources to the MSR holdings themselves.

In 2012, New Residential sought and obtained approval from the Internal Revenue Service for the REIT to invest in "excess MSRs," essentially the profit that's left after servicing costs are paid out from MSR revenue.

New Residential's buying spree reflects a greater availability of MSRs that have attractive enough returns to meet its investment objectives. But "we're not going to acquire every mortgage servicing right for sale," said Michael Nierenberg, New Residential's CEO.

New Residential's investment strategy is effective regardless of interest rate fluctuations, because it doesn't only invest in new MSRs, Nierenberg said.

"With higher rates, the valuation of the assets will likely increase. Keep in mind a large portion of our mortgage servicing rights are seasoned or credit impaired. That will be a buffer," if interest rates on new MSRs go down, said Nierenberg. "Conversely, if rates go up, it will be good for the asset class."

Nonbank servicers are also finding greater availability and more options for borrowing against their MSRs. In a market where short-term MSR financing backed by agency portfolios have been more prevalent, Freedom recently secured a long-term

These types of loans give nonbank lenders "a lot of flexibility in a more challenging origination environment," where "most companies in the space will want extra capital," said Stephen Lynch, a director at Standard & Poor's Global Financial Institutions Ratings.

"It is telling that they were able to get it done with an asset class banks usually shy away from due to its liabilities and credit profile," he said.