Remember strategic defaulters, those homeowners who walked away from their underwater mortgages even though they could still afford their loans?

They're back; this time, as prospective borrowers.

Strategic defaulters are arguably among the riskiest of these so-called

Because of all this, the mortgage industry is considering whether walking away from a home is a risk that could recur, and if so, whether this behavior can be predicted and managed better in the future.

"Someone who has a catastrophic incident like a death, an illness, temporary job loss, things like that, in those cases lenders should always work with consumers," said Steve Calk, chairman and CEO of The Federal Savings Bank. "Our willingness to stretch and take chances on people who may have lost everything but their home, yet continued to live up to that obligation, is very, very, important to us."

But if lenders know an underwater borrower defaulted despite the ability to pay, they might view that default history more negatively in future lending decisions.

"'Strategic' default, which is simply a financial decision where someone chose to get overleveraged and tried to get rich leveraging the lender's and the investor's money, that's unacceptable," Calk said.

"I find the term 'strategic default' extremely offensive. Deliberate default for personal gain is not strategic, it's just default," he added.

Lenders generally acknowledge that unsustainable home price inflation driven by industry-wide loosening of underwriting was a main driver of strategic defaults when the housing bubble popped.

"Overinflated real estate market values did hurt the availability and the economic opportunity for people who really wanted to own a home and almost a generation of future homebuyers, because of the equity that disappeared almost overnight," said Calk. "But now I think people are rebuilding confidence in the marketplace."

Borrowers most often strategically defaulted when their loan-to-value ratios were well over 100%.

"The strategic defaulter really starts to kick in around 125-130% LTV, and a lot of the strategic defaulters defaulted at levels much more negative," said Frank Pallotta, CEO of Steel Curtain Capital Group LLC, a mortgage industry advisory and consumer marketing firm.

So as long as lenders maintain relatively low LTV limits and the housing market remains strong, strategic default is unlikely to re-emerge as a risk.

But the housing market is notoriously cyclical, the influential government-sponsored enterprises are cautiously showing interest in

Up to 20% of Defaults

"Strategic" defaulters, defined by Experian as borrowers who went straight to 180-plus days delinquent on their mortgages while remaining current on their other debts, represented as much as 20% of overall mortgage defaults in the fourth quarter of 2008, when market distress was particularly high.

By other definitions, the percentage of overall strategic defaults looks smaller but still remains significant.

A strategic default study published last year by Equifax, CoreLogic and Urban Institute researchers applied the Experian research's criteria to a new data set. It found that when consumer income and debt are both taken into consideration, the percentage of borrowers that defaulted for reasons not linked to their ability to pay is lower, closer to 10%. Percentages in a particular region with severe home price depreciation could be much higher.

The 2015 study examined whether borrowers had mortgage debt that exceeded the value of their properties and hadn't experienced a loss in income during the six months prior to the loan default. It reviewed defaults between June 2008 and June 2011.

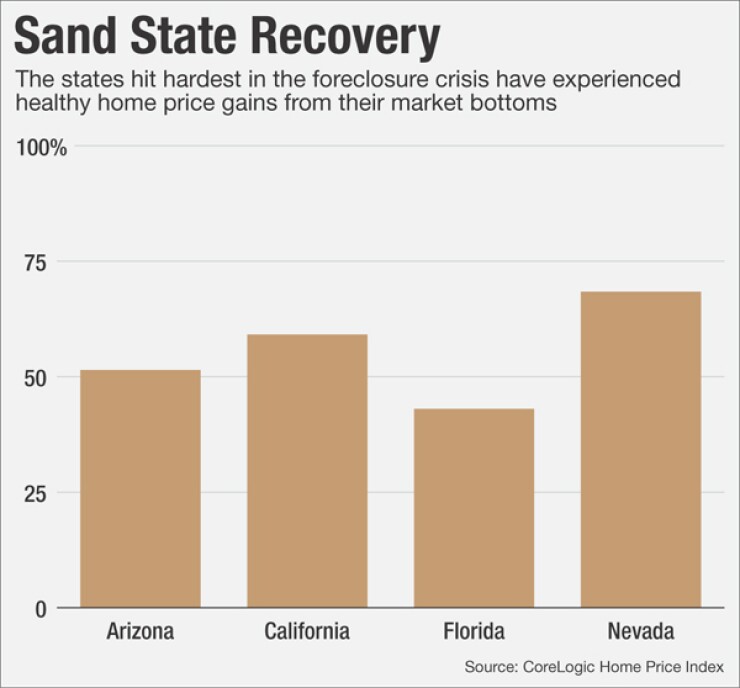

But the real test is what happened in Arizona, California, Florida and Nevada, Equifax chief economist Amy Crews Cutts said, the four "sand states" where huge home price swings produced the bulk of the underwater loans and strategic defaults.

CoreLogic found more than half of the

The strategic default phenomenon has changed consumers' view of the value of mortgages and their home equity for the long term.

"I think they don't have the blind view of, 'I want to own property. It's always better to own a home because you're putting money toward equity,'" said Pallotta. "Their view is what happened to their uncle's equity. He paid for years and he was still underwater."

With the exception of large, hot real estate markets like San Francisco, most strategic defaulters didn't see credit improve faster than home prices. But common experience with negative equity is what makes strategic default look more socially acceptable to borrowers.

"The higher the strategic default rate was around you, the more likely you were to strategically default," Crews Cutts said.

As lenders seeking new sources of purchase originations give many of these borrowers a second chance, it raises the question of whether these consumers found strategic default rewarding enough to put them at risk of doing it again, or whether borrowers had regrets in retrospect that might deter them in the future.

Although the possibility of strategic default will likely be something more consumers will be aware of and consider in the future than before the downturn, borrowers probably won't be as quick to pursue it as they initially were during the Great Recession due to both mixed experience with the practice and the increased availability and proliferation of loss mitigation options.

Government loss mitigation options like the Home Affordable Modification Program will eventually end. But proprietary modifications, which tend to be more common, are expected to continue in the long term.

Whether strategic defaults paid off at the borrower level really depends on how consumers ultimately felt about the experience for reasons that may or may not be rational. For some, this is about more than the financial outcome of the decision.

Even those who financially benefited from strategic default, for example, could have some other regrets.

"They might think, 'Maybe I shouldn't have done it, I don't know what it did to my neighborhood, maybe it was the wrong thing,'" Pallotta said.

One thing all of those who chose to do strategically default had in common was an interest in escaping loans that exceeded home values. Not everyone had the timetable of seven years of bad credit in mind when they walked away. Some feared their homes' market prices would never rebound at all. If this was the case, they were wrong.

"If your point was, 'I'm never going to regain my value,' that wasn't the case. The hindsight there was you shouldn't have done it," said Equifax's Crews Cutts.

But how much recovery, and how fast it occurred, is really more to the point of whether or not it literally paid on an individual basis to strategically default.

"You'd regret walking away from the home if, in a very short period of time, the home went up above the value that you were able to pay off your mortgage at," said Pallotta.

Analysis Can Be Done, but Should It?

Ultimately, while lenders and servicers have ways they could distinguish "strategic" defaulters from "hardship" defaulters and manage their relative risks, whether they should do so remains another story.

For one, it can be tough for lenders to tell whether a default in a borrower's history was strategic or not.

"There's not much you can do to uniquely identify it," said Stan Baldwin, chief operating officer of mortgage risk management and data firm Informative Research in San Diego.

And as differences between the Experian and Equifax studies show, distinctions that exist are arguable. Is, for example, an underwater home a financial hardship for a borrower? It could be considered one, and regulators may not take kindly to disincentives to a possible remedy for it.

What's more, there's not much to stop borrowers from strategically defaulting. While strategic default does generally breach borrowers' promise to repay the debt, it's a breach with a prescribed remedy: foreclosure.

"There is nothing illegal about it," said Crews Cutts.