Appraiser and homeowner opinions on home values continue to converge, with the gap between the two viewpoints narrowing for the fifth consecutive month, according to the Quicken Loans Home Price Perception Index.

Nationwide, appraiser values were an average of 0.99% lower than homeowner expectations, making the Home Price Perception Index the closest it's been to equilibrium since April 2015.

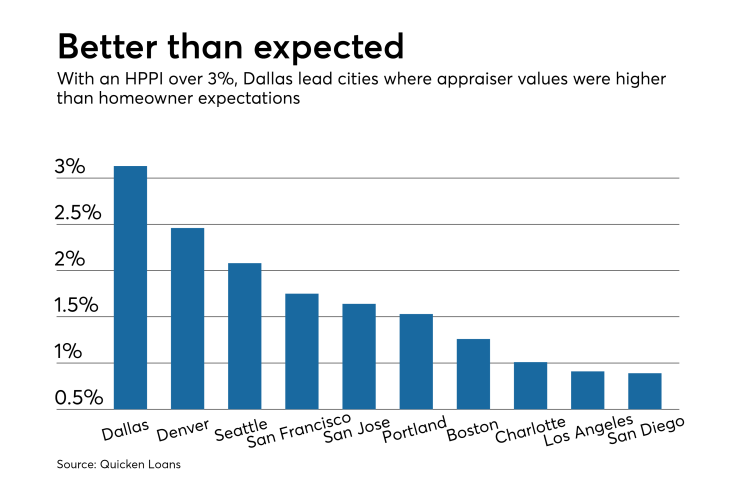

In Western cities, the trend of appraiser opinions being greater than homeowner projections continued, with appraised values as much as 3.13% higher than expectations in Dallas.

"Based on the HPPI, it appears homeowners in the markets where prices are rising faster than the national average, like Denver, Seattle and San Francisco, are continuing to underestimate just how quickly home values are rising, so the average appraisal is higher than homeowner estimate," said Bill Banfield, Quicken Loans executive vice president of capital markets, in a press release.

"On the inverse of that, homeowners in areas where the values aren't rising as fast may think they are rising faster than they are, leading to the appraisal lagging the estimate."

Home prices rose in October by an average of 4.76% from the same period last year, and grew month-over-month by 0.71%

"As we enter the traditionally slower demand season in the home purchase market, persistent supply constraints may keep home prices elevated," said Banfield. "Compared to the previous year, our economy continues to improve and attract home buyers who may have been on the sidelines during the past few years. This will add additional demand to the equation."