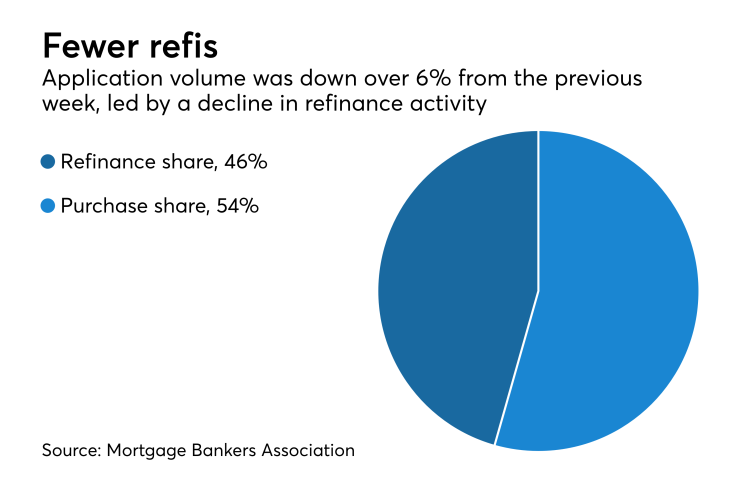

Mortgage application activity fell by 6.2%, driven by a 9% decrease in refinancings, according to the Mortgage Bankers Association.

The MBA's Weekly Mortgage Applications Survey for the week ending June 23 found the seasonally adjusted purchase index was down 4%

On an unadjusted basis, the purchase index decreased 5% compared with the previous week. It was 8% higher than the same week one year ago.

The refinance share decreased to 45.6% of total applications from 46.6% the previous week.

Adjustable-rate loan application activity fell to 7.0% from 7.5% for the week before. The Federal Housing Administration share increased to 10.3%, while the Veterans Affairs share decreased to 10.3% and the U.S. Department of Agriculture share remained unchanged at 0.7%.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) remained unchanged for the second week in a row at 4.13%. For 30-year fixed-rate mortgages with jumbo loan balances (greater than $424,100), the average contract rate increased 1 basis point to 4.09%.

The average contract interest rate for 30-year fixed-rate mortgages insured by the FHA decreased 2 basis points to 4.02%, while for 15-year fixed-rate mortgages, the average decreased 1 basis point to 3.39%.

The average contract interest rate for 5/1 ARMs increased 5 basis points to 3.31%.