Annual home price growth

Western states, especially those that saw large migrations during the pandemic, were the hardest hit, as outside of that region only New York – down a scant 0.3% – and the nation's capital – with an even smaller 0.1% – saw prices decline.

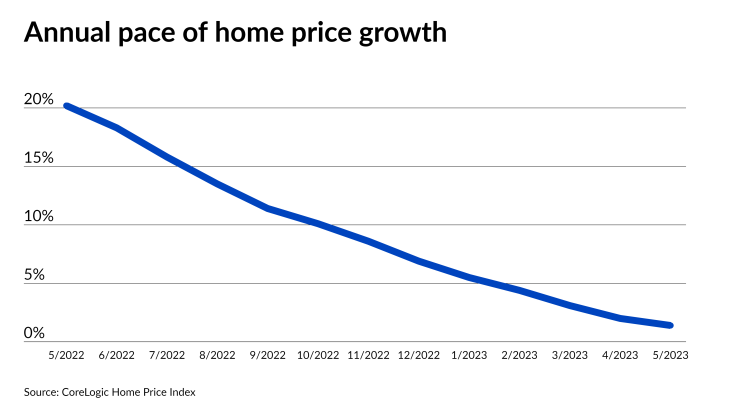

Nationwide, prices rose 1.4% year-over-year in May, with a month-to-month increase of 0.9%, the CoreLogic Home Price Index noted. That makes 136 consecutive months, or over 11 years, where prices have increased annually.

"After peaking in the spring of 2022, annual home price deceleration continued in May," said Selma Hepp, chief economist at CoreLogic in a press release. "Despite slowing year-over-year price growth, the recent momentum in monthly price gains continues in the face of recent mortgage rates increases."

Last week the 30-year fixed rate mortgage was at

The last time prices rose less than 2% compared with the prior year was in early 2012, CoreLogic said.

In April, the annual gain was 2%, and the month-to-month rise was 1.4%.

"Nevertheless, following a cumulative increase of almost 4% in home prices between February and April, elevated mortgage rates and high home prices are putting pressure on potential buyers," Hepp said. "These dynamics are cooling recent month-over-month home price growth, which began to taper and is returning to the pre-pandemic average."

Prices

On the other hand, Maine had a 7.2% annual price increase, followed by New Jersey, up 7.1%.

Going forward, CoreLogic predicts nationwide prices will rise by 1% between May and June and increase 4.5% through May 2024.

The market identified as most at risk for a price decline over the next 12 months is Provo-Orem metropolitan area in Utah. The next four markets are all in Florida: Lakeland-Winter Haven; North Port-Sarasota-Bradenton; Cape Coral-Fort Myers; and Port St. Lucie.

The

For the week of June 30, the median price of all single-family listings was $444,428, up 0.1% from one year prior, while the median closed price was $424,921, up 0.9%. When compared with the same time in May, the median listing price of single-family listings was 0.6% lower but the median closed price rose 2.7%.

"In the face of a challenging economic landscape with declining inventory and rising removals, the housing market has shown remarkable resilience, as evidenced by the upward trajectory of listed and closed prices," HouseCanary CEO Jeremy Sicklick said in a press release. "Looking ahead to the second half of the year and Q3, we anticipate continued subdued market activity and a slow pace of rate hikes by the Federal Reserve."