Angel Oak Mortgage, a company that buys home loans made to nontraditional borrowers, launched a downsized

The real estate investment trust, which also buys small-balance commercial mortgages, priced its offering of 7.2 million shares at a starting price of $19 each. Underwriters have the option to purchase an additional 1.08 million shares of the company’s stock within 30 days. The company originally had planned to sell 8.05 million shares at a price of $20-$21 each, and give underwriters the option to purchase roughly an additional 1.21 million shares. At the completion of the offering, Angel Oak will sell more than 2.1 million shares of its common stock to CPPIB Credit Investments Inc. in a concurrent private placement at $19.00 per share.

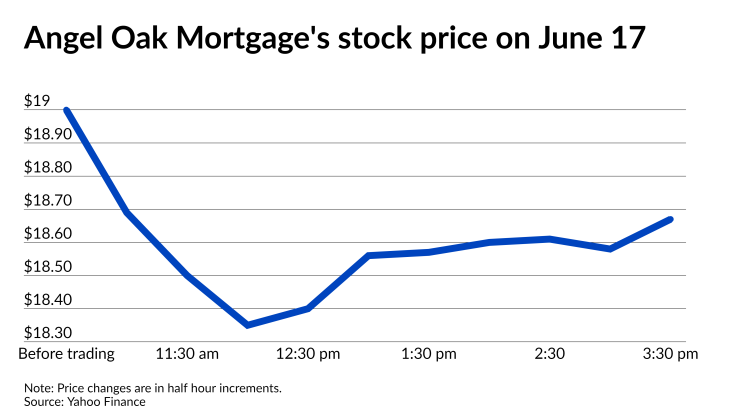

The relatively steady public demand for the company’s stock suggests investors are receptive to the notion that lending to certain self-employed borrowers and others who don’t have W-2 incomes could be a growth engine for lenders as

The onset of the pandemic temporarily disrupted the market for non-QM loans last year, but it has

Recent examples include the privately-held Sprout Mortgage’s

Other publicly traded nonbanks with expertise in non-QM include