The negative publicity about loanDepot's workplace culture apparently had little effect on the company's third quarter operations.

During the conference call, Chief Financial Officer Patrick Flanagan addressed the wrongful termination lawsuit filed by

Richards alleged the company was trying to boost volume prior to its

"These lawsuits and their claims have not resulted in any material adverse impacts from our warehouse lenders to the agencies or investors," Flanagan said. "We have not at this time recorded a liability related to these lawsuits."

He reiterated prior statements that the company intends to vigorously defend itself against these actions.

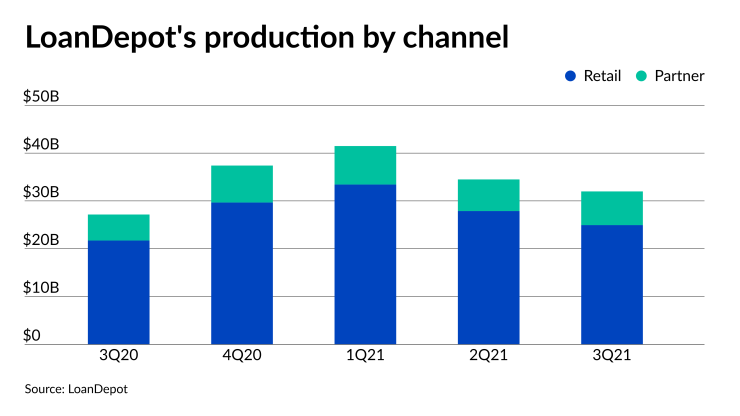

While the Mortgage Bankers Association's latest forecast had a near 13% quarter-to-quarter decline in originations, at loanDepot, the drop off was only 7% to just under $32 billion for the third quarter from $34.5 billion

On a year-over-year basis, loanDepot also outperformed the market, with a 17% increase from the $27.2 billion originated in the third quarter 2020. The MBA forecast expects a 20% decline over that interval for the market overall.

Based on numbers from the MBA, loanDepot had a 46% year-over-year increase in market share, to 3.5%, said CEO Anthony Hsieh.

"To put that increase into perspective, while the third quarter of 2020 was our most profitable quarter ever, our largest annual increase in market share came after that, demonstrating the resiliency and strength of our diversified channel strategy," Hsieh said.

Its partnership channel saw production rise to $7 billion from $6.6 billion in the second quarter and $5.4 billion in the third quarter of 2020. Retail production totaled $24.5 billion in the third quarter, down from $27.9 billion one quarter prior but up from $21.7 billion one year prior.

Third quarter gain on sale margin increased 56 basis points to 284 bps from 228 bps in the second quarter. But that was down 203 bps from the third quarter's 487 bps, a period of unusually high gain on sale margins industry-wide.

LoanDepot's net income followed the same pattern. The company earned $154.3 million in the third quarter, up from $28.3 million in the second quarter, but down from $728.3 million in the third quarter of 2020.

"Our marketing engine and customer acquisition abilities are one of the best in the business," Hsieh said. "Notably in October, we wrapped up the successful first year of our multi-year

LoanDepot believes it will have between $26 billion and $31 billion of loan originations in the fourth quarter. Its pull-through weighted gain-on-sale margin — based on pull-through weighted rate lock volume — should be between 210 and 260 bps. That is down from the 299 bps the company reported for this metric in the third quarter.

The company's servicing portfolio grew to $145.3 billion on Sept. 30 from $138.8 three months prior and $77.1 one year prior, as it increased the number of loans it retained the rights on after sale. Still, the company did sell $13.5 billion of mortgage servicing rights during the quarter.

LoanDepot plans to be an acquirer in a consolidating mortgage market, Hsieh said in response to a question.

"As pressure continues to mount, you're going to see lots more opportunities. The challenge here is, do we want to take 10 small bites or you want to go after one big bite?" he asked, noting that integration is the significant task to successfully doing transactions.

In terms of acquisition strategy, Hsieh referred to past deals, such as back in 2015, when loanDepot acquired

"We're constantly evaluating. We're looking for quality companies that have a culture match," Hsieh said. "And as this pressure continues to mount, the targets will get cheaper, so we're very, very patient."