Altisource Portfolio Solutions is adding its online "for sale by owner" real estate platform to the list of noncore businesses it is shutting.

"Owners.com has been making encouraging progress in demonstrating that a better consumer real estate model based on technology and service may be viable. However, as we continue to work to simplify Altisource and focus on our larger opportunities, we concluded that closing Owners.com is in Altisource's best interest given the time horizon and level of additional investments needed in order for Owners.com to operate independently," William Shepro, Altisource's chairman and CEO, said in a press release.

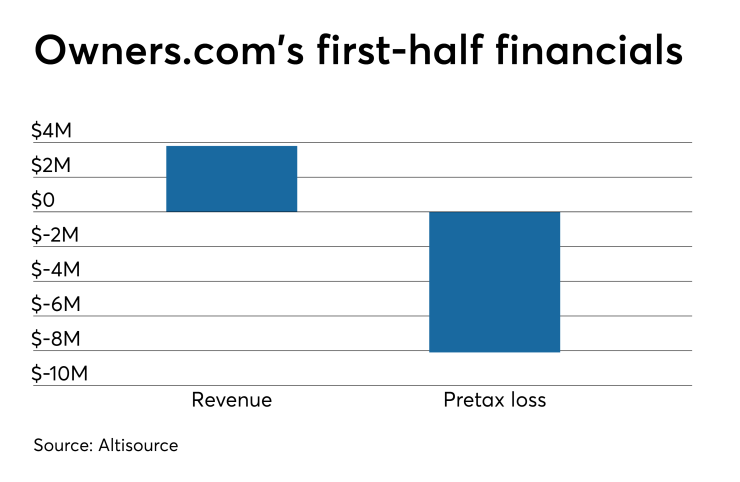

The for-sale-by-owner platform generated $3.8 million in revenue and an $8.1 million pretax loss, during the first half the year. Luxembourg-based Altisource estimates it will recognize a $5.9 million noncash goodwill and intangible assets impairment charge related to Owners.com in the fourth quarter. The company also expects to recognize other wind-down and severance costs at that time.

Altisource also recently sold the majority of its buy-renovate-lease-sell properties and its financial services and mortgage charge-off collections business, according to the company's

The company has had some success generating gains through its field services business and Hubzu, a website used to auction off real estate owned properties. Altisource also recently launched a series of services for the single-family rental market and has been developing a customer analytics business line. A subsidiary of Altisource manages the Lenders One mortgage cooperative.