But while the company's second-quarter net loss of $5.8 million marked an improvement over the

Charges associated with ongoing efforts to cut ties with

Altisource's more than $190 million in second-quarter service revenue dropped 9% from a year ago primarily due to the reduction in its Ocwen and Front Yard Residential Corp. portfolios.

"I am very pleased with our progress in streamlining Altisource. We recently sold the majority of the

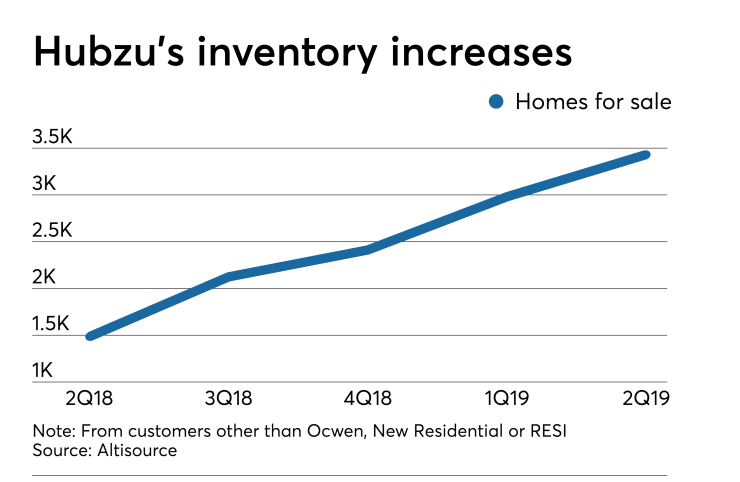

"We are also focusing on larger opportunities, including those in our marketplace and field services businesses, where we are making considerable progress. Our ongoing success at winning and on-boarding new business is demonstrated by our 131% growth in Hubzu inventory and 17% growth in field services revenue from customers other than Ocwen, New Residential Investment Corp. and RESI, compared to the second quarter of 2018. Given recent market expansion, program launches with new clients, and scheduled on-boardings, we anticipate these trends to continue."

Analysts had mixed reactions to the company's net loss of $0.36 per share, which adjusts to a net gain of an equal amount when nonrecurring charges are removed.

Altisource's adjusted EPS outperformed by $0.36 and service revenue outperformed by $20.6 million, according to Seeking Alpha. But the company's adjusted EPS missed Zacks' consensus estimate by $0.20 even though its revenue outperformed consensus by more than 15%.

The company's stock price alternately rose and fell in response to its results Thursday morning. It was trading at $20.44 shortly before noon Eastern, when it was down nearly 5% on the day.

Altisource is a spinoff of Ocwen founded by Ocwen's former chairman William Erbey.

Ocwen has faced

Altisource previously operated Ocwen's existing proprietary system of record, but Ocwen has since moved its portfolio to