In cities across the country, the affordable housing situation spans a bleak spectrum. It lagged behind goals set

"The lack of affordable housing is presenting significant challenges to families across the country. We need to explore how the lending community can better partner with public, private and nonprofit stakeholders to ensure more Americans have access to homes they can afford,"

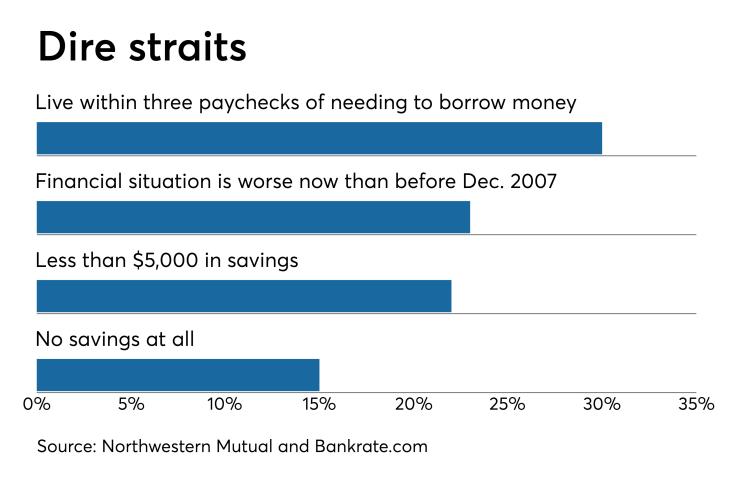

Personal economic stability is an issue as 30% of Americans currently live week-to-week, within a three paycheck window of needing to borrow money, according to Northwestern Mutual. Additionally, 23% said their financial situation is worse now than before the Great Recession started in December 2007, according to Bankrate.com.

"People are skating on some very thin ice financially," said Emily Holbrook, senior director of planning with Northwestern Mutual. "While there are some signs of improvement since last year we still have a long way to go, and for most Americans there's no way to get there without a plan."

Addressing the affordable housing need would go a long way to digging people out of financial straits. Steve O'Connor, a senior vice president at the MBA with 23 years under his belt, will head the initiative.

"Housing affordability is an issue facing millions of Americans, both those who rent and those who want to buy a home," O'Connor said. "There is no easy solution. The only way we are going to solve this is by getting lenders together with policymakers, consumer advocates, community leaders and other stakeholders, and using our collective knowledge and experience to find the answers."

The issue is getting recognition from city councils and institutions alike. Earlier this month,