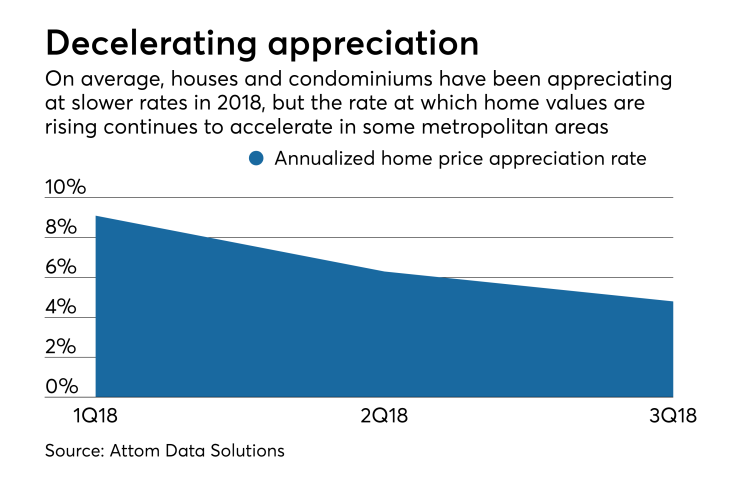

Home price appreciation is continuing to decelerate due to affordability concerns that are unlikely to let up even though recent market developments have put some downward pressure on mortgage rates.

The median price for single-family homes and condominiums was $256,000 in the third quarter, according to Attom Data Solutions' Home Sales Report. That represents a 4.8% appreciation rate compared to a year ago.

The annual home price appreciation rate hasn't been this low since the second quarter of 2016.

"The continued slowdown in the rate of home price appreciation nationwide and in many local markets is a rational response to worsening home affordability, which has deteriorated at an accelerated pace this year due to

A rout in stock prices such as on Wednesday generally has implications for the bond market that could drive rates lower and help relieve affordability pressures. But in this case the downward pressure on rates was limited.

"Yesterday's trade didn't help borrowers much," Walter Schmidt, a senior vice president and manager of mortgage strategies at FTN Financial, said in an interview.

Investors' flight into bonds from equities is what can put downward pressure on rates when the stock market tanks, but investors were less interested in mortgage-backed securities on Wednesday than they were in Treasuries. So there was minimal downward pressure on mortgage rates as stocks declined in value.

Higher mortgage rates aren't slowing appreciation in all areas. Annualized home price appreciation was slower during the third quarter in only 74 of 150 metropolitan statistical areas Attom analyzed.

"Markets not experiencing this price appreciation cooldown may have more of an affordability cushion to work with, but some are in danger of overheating if home price gains continue to run hot," said Blomquist.