Lenders in January reversed

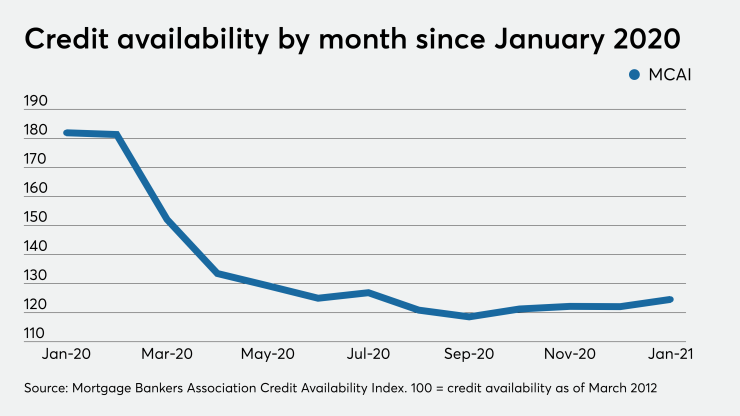

The Mortgage Bankers Association’s credit availability index last month ticked up 2.5 points to 124.6 from 122.1, but that number was down markedly from 181.9 a year ago.

The index’s movement suggests that lenders want to accommodate consumers buying homes amid forecasts of diminished refinancing, but they aren’t yet ready to lend as freely as they did before the pandemic.

“Even with overall credit availability picking up in three of the past four months, credit supply is still at its tightest level since 2014,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting, in a press release.

While the ARM market share remains very small, an uptick for this loan type may indicate that some borrowers are looking for slightly lower initial rates prior to an adjustment period. The fact that there’s been a slight dip in the credit score allowable suggests lenders are looking to do more to address affordability considerations as well.

The jumbo component of the index rose by 2.2% week-over-week but there was an even larger increase — 7.7% — among loans within Fannie Mae and Freddie Mac’s

Underwriting of government-insured loans that generally serve the needs of lower-income borrowers tightened 0.1%, suggesting lenders are somewhat cautious about this sector. The rate at which borrowers have been putting payments on hold for coronavirus-related contingencies has been higher in the government market than the conforming market. Government loans had a 7.46% forbearance rate, compared to a 3.07% for conforming mortgages, in the MBA’s

The MCAI is based on data from the widely-used Ellie Mae mortgage origination system owned by Intercontinental Exchange. The index’s baseline of 100 represents underwriting conditions in March 2012, which credit was relatively tight.