There is now less fraud risk associated with adjustable-rate mortgage applications and this will offset some of the higher hazard associated with

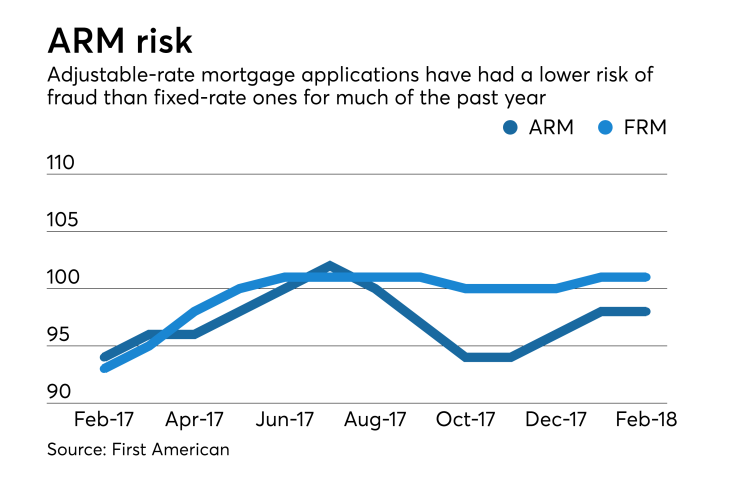

February's loan application defect index for ARMs was 98, while for fixed-rate mortgages it was 101, according to First American Financial; both were unchanged from January. Since April of last year, the ARM index has been lower each month except in July.

Historically, consumer demand for ARM loans increases when mortgage rates rise. The most recent Mortgage Bankers Association application survey had

"At the height of the housing boom, ARMs were all the rage, and many included additional elements that added risk, such as negative amortization, payment-option and interest-only options, and teaser-rate ARMs," said First American's Chief Economist Mark Fleming in a press release.

"Today's ARM is not like those of the past. It is essentially the same as the 30-year, fixed-rate mortgage with one difference — rates adjust after an initial fixed period of usually five or seven years. Saving half a percent on the mortgage rate may be worthwhile for many consumers, especially if their expected tenure length in the house is not 30 years."

"As mortgage rates

Typically, ARM applications had a higher risk of defects than those for an FRM. In November 2013, the ARM defect index was 136 and the FRM index was 120. But the spread between them narrowed to just 2 points in December 2016.

The overall index

The purchase loan defect index was 91 in February, down from 92 in January but up from 85 for February 2017. For the fifth month in a row, the defect index for refinancings was 69, but in February 2017, it was 61.