Almost half of homeowners more than 90 days behind on mortgage payments currently have no loss-mitigation plan, according to a recent report from the Federal Reserve Bank of Philadelphia.

With protections that prevent servicers from initiating foreclosures about to end,

“Unless mortgage servicers can successfully execute home-retention options, millions of borrowers face the prospect of selling their homes or losing them to foreclosure,” the report said.

While a federal moratorium on foreclosures expired over the summer, the Consumer Financial Protection Bureau introduced amendments that enabled distressed borrowers to work with servicers to prevent immediate foreclosure proceedings. Those protections end on Dec. 31.

The Philadelphia Fed estimated that 1.16 million borrowers are classified as

Of the additional

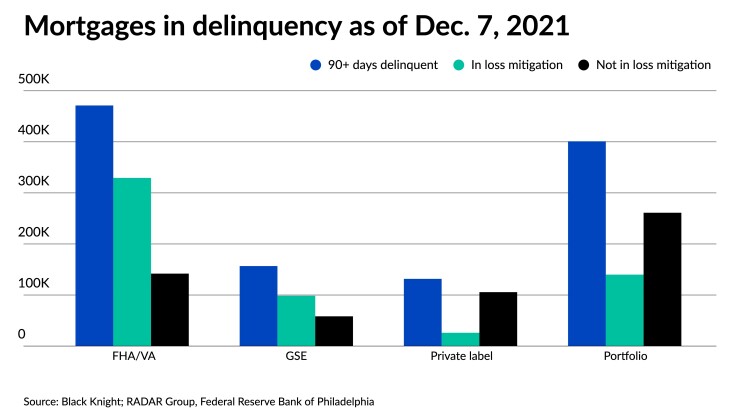

Among the total number of seriously delinquent loans, 471,000 are backed by the Federal Housing Administration or Department of Veterans Affairs, with 70% currently in loss mitigation. Mortgages in the GSE pool account for almost 157,000, with 63% in a loss mitigation plan. The number found among private-label mortgage backed securities or bank-held portfolios total approximately 132,000 and 401,000, respectively. As private-label and portfolio loans do not qualify for the primary loss-mitigation plans on offer by U.S. government agencies, the percentage of those borrowers taking home-retention options amount to only 20% and 35%.

The U.S. Department of Housing and Urban Development and the Federal Housing Finance Agency permit forborne homeowners who work with their servicers to make up for payments missed during forbearance through a lump-sum remittance or a deferral or partial claim, where missed payments are put into a noninterest-bearing subordinate lien and paid when the mortgage is refinanced or the home is sold.

For borrowers unable to resume regular payments, loan modifications are also offered by the FHFA or HUD for GSE-backed and government-sponsored mortgages. Researchers at the Philadelphia Fed estimated that borrowers who accepted any of the three federally-insured modifications available saw their payments on principal and interest reduced between 27% and 33%.

The report also found that the burden of mortgage distress fell on a higher percentage of Black homeowners compared to other racial groups. Among non-Hispanic Black borrowers, 9.1% had fallen behind on payments, while only 3.3% of non-Hispanic Asians and 3.8% of non-Hispanic whites were struggling. Among non-Hispanic homeowners of other races, 6.6% were behind, while 6.5% of Hispanic homeowners had missed payments. The percentage of distressed borrowers included those in forbearance, as well as delinquent homeowners with or without loss mitigation plans in place.