With housing prices continuing their years-long climb, home sellers cashed in on their highest returns since 2006, according to Attom Data Solutions.

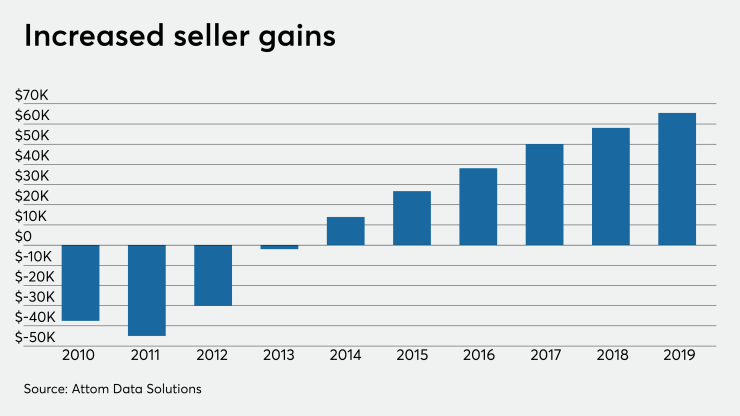

Compared to the original prices paid, homeowners made an average of $65,500 or 34% return on investment per home sale in 2019. Those figures rose from $58,100 and 31.4% a year earlier and leaped above the negative return of $37,523 or 19% loss in 2010.

"The

While profits increased for eight consecutive years, the growth curve is leveling off and could be pointing to a course reversal starting in the not-so-distant future.

For housing markets with populations above 200,000, the biggest profit margins all came from the West Coast. The top four by ROI stayed static compared with 2018, led by San Jose, Calif., at 82.8%, then San Francisco at 72.8%, Seattle at 65.6% and Merced, Calif., at 63.2%.

The overall U.S. median home price reached a new peak of $258,000 in 2019. That sustained growth amounted to 6.2%, up from 4.5% in 2018. About 78% of metro areas over 200,000 in population also hit their individual peak median prices. South Bend, Ind.'s 18.4% gain was the largest year-over-year increase, followed by increases of 12.6% in Boise, Idaho, and 10.9% in Spokane, Wash.