When a consumer refinances or pays off her house in preparation for moving, you might expect her to reduce other debts to help get the new mortgage application approved.

But the average prime-credit mortgage borrower doesn't do this, according to a new report from TransUnion based on so-called trended credit data — the kind of detailed information Fannie Mae will be

TransUnion's findings, to be published Thursday, show how this kind of data has broad lead generation and risk management uses. Consumers getting ready to refi or move house might be better prospects for pitching other products than commonly thought, for instance. The credit bureau plans to unveil the study at its financial services summit in Chicago.

"Some of the insights the trended data reveals are telling you on the mortgage side something about consumers' ability to pay that a credit score can't tell you, and if you're a card issuer, those same insights also are really going to help," said Charlie Wise, a vice president at TransUnion.

Trended credit data includes more details about consumer use of credit over time than home mortgage lenders have typically looked at. These include payment and payoff amounts and information on whether borrowers tended to pay off their cards each month or more typically paid the minimum and carried a balance.

When it introduced its plan to require trended credit data last fall, Fannie noted that it will likely be the first time details about consumer use of credit, including payment amounts, are broadly examined by mortgage businesses.

"It's been used in other lending markets," Fannie spokesman Andrew Wilson noted. Auto lenders, for example, have used trended data.

Two of the three major credit reporting agencies — TransUnion and Equifax — will be providing the trended data and the third, Experian, could at a later date.

Banks or mortgage companies active in providing other forms of consumer finance might find trended data particularly useful if they aren't examining it already. Freddie Mac also has expressed interest in eventually collecting trended data with its mortgage purchases.

Mortgage lenders selling loans to Fannie won't have to analyze the data they provide to the government-sponsored enterprise. But they may want to, since they have to obtain it anyway.

Some of the data could upend commonly-held assumptions, like the belief that credit card spending dips right before a mortgage borrower closes on a new loan.

"Our expectation going in was that people pay down their balances, drop spending and then resume it afterwards," Wise said. "That hypothesis is wrong because what we found was people actually had a spike in their credit card and retail card spending."

TransUnion's recent study of 16.7 million consumers found spending on general-purpose credit cards, for example, was on average 1.1 to 1.8 times higher for borrowers who were moving. It was 1.7 to three times higher for those refinancing.

Retail and private-label card spending was 1.4 to 1.7 times higher for those moving and 1.6 to 2.4 times higher for those refinancing.

The card spending tended to be higher for those with slightly lower credit scores within the prime range, defined as scores of 660 or higher.

Mortgage lenders often recheck credit scores when it's getting near time to close the loan. This ensures that changes in credit spending are considered in underwriting, but the scores can be a "black box," said Eric Webb, underwriting manager at Churchill Mortgage.

The trended credit reports will give lenders more visibility into underlying behavioral changes, he said.

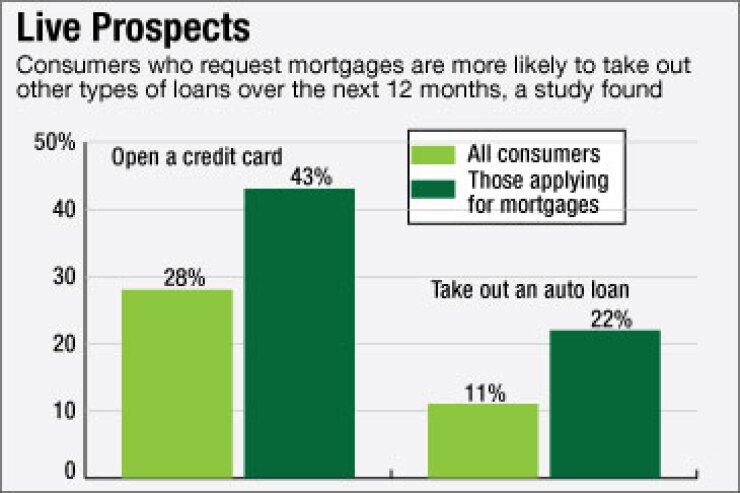

Other TransUnion findings were less surprising, said Wise. While consumers who are refinancing or relocating don't necessarily wait to increase their spending on existing credit accounts when getting a new loan, they do tend to put off getting a new card or auto loan. They are more likely to eventually get one, though.

In a typical 12-month period, 11% of all consumers open an auto loan and 28% of consumers get a new card. However, 43% of consumers with a mortgage inquiry get a new card in the next 12 months and 22% get an auto loan.