The housing finance division of a depository holding company is putting an unusual, older package of government-sponsored enterprise servicing rights up for sale this week through Incenter Mortgage Advisors.

The unnamed seller is staging the bulk sale due to

The MSR package comes from the era before 2020’s pandemic, rate drop and refinance boom, and represents a sizable deal for that timeframe. The loans in it are around two and a half years old, and have a 3.5% weighted average coupon.

“What has been offered as of late are 3% type rates and anything between $5 and $10 billion was a large trade then,” noted Tom Piercy, managing director of IMA.

While borrowers refinancing at

“There are refinance capabilities in this and how much of that recapture will be embedded in the price that’s offered in order to win will be interesting,” he said.

Less than 0.3% of the loans have short-term delinquencies. The share of mortgages in coronavirus-related forbearance, particularly those from Fannie Mae and Freddie Mac, has been

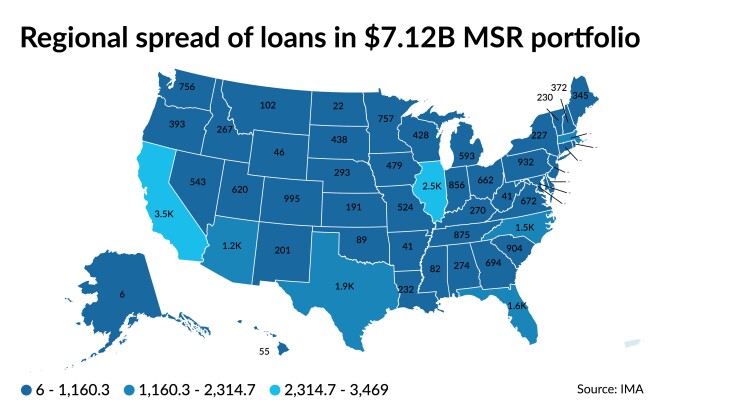

There’s broad geographic dispersion of the loans in this MSR sale, with the largest concentration being in California at 14.6% based on outstanding balance and 10.9% based on count.

Also diverse are the types of loans and rates found in the package, which range from typical 30-year fixed products to hybrid adjustable-rate mortgages and low down-payment products.

Written bids are due by noon Mountain time on Thursday. The seller would like the sale to take place no later than May 31 with mutually agreed-upon transfer dates.

No electronic notes are involved in the sale but the seller uses Mortgage Electronic Registration Systems for all its production and buyers should be MERS capable or ready. Imaged documents are available and servicing will be transferred from Finastra’s system.