For many first-time homebuyers, surging home prices have overshadowed potential savings from record-low interest rates

In response to the outbreak of COVID-19 and the resulting economic shocks experienced by the U.S. and global economies, the Federal Reserve slashed its target interest rate to nearly zero and kept it between 0% and 0.25% from March 15, 2020, until March 16, 2022, when the Fed announced it will raise the target interest rate by 25 basis points to 0.25-0.5%. For existing homeowners, the resulting low interest rates meant opportunities for billions of dollars of savings in mortgage interest, prompting millions of homeowners to refinance their existing mortgage for a lower rate.

Record-low interest rates also meant that for many, it was the right time to buy a home and invest in wealth-building homeownership.

As millions of existing homeowners geared up to refinance, many potential homeowners were ready to take advantage of this opportunity to buy a property and lock in low financing costs. Many homebuyers were also seeking amenities such as larger living spaces, fenced backyards and spare rooms for offices as COVID-19 mitigation strategies drove remote work and intensified the demand for space and privacy — amenities that are typically lacking in urban locations, apartments or small rental homes.

However, the real savings that many potential buyers expected from record-low interest rates were quickly outstripped by the pandemic-fueled housing demand and price increases that followed a temporary market shutdown. Fueled by low interest rates and rising demand but constrained by limited supply, the pandemic housing market became one of the hottest on record. According to the CoreLogic National Home Price Index,

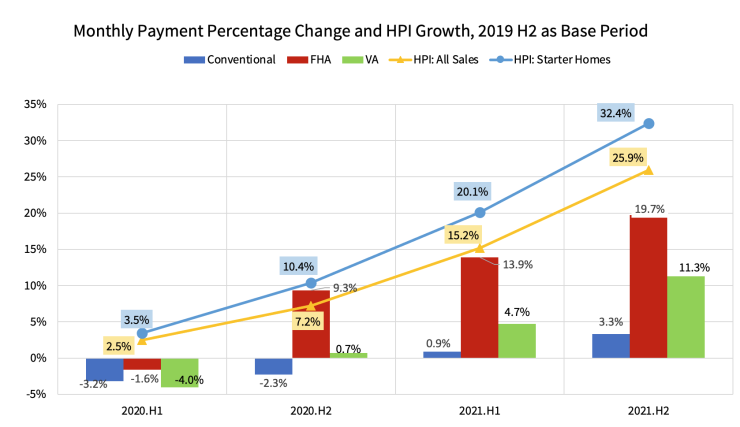

Figure 1 plots the amount spent on a typical mortgage payment for newly originated purchase loans, breaking down the trend by the source of financing. Figure 2 shows the corresponding percent changes in monthly mortgage payments during the pandemic. The typical monthly payment includes principal and interest (P&I), property taxes, homeowners’ insurance, HOA fees and mortgage or flood insurance, if applicable[1]. Together, these monthly out-of-pocket cash obligations indicate the recurring cost of homeownership.

Figure 1 Typical Monthly Mortgage Payment by Source of Financing

Source: CoreLogic Loan-Level Mortgage Analytics Data; CoreLogic HPI.

© 2022 CoreLogic,Inc., All rights reserved.

Note: The monthly mortgage payment is based on 30-year, fixed-rate home-purchase loans.

Figure 2 Rising Monthly Mortgage Payment and Rising Home Prices During the Pandemic

Source: CoreLogic Loan-Level Mortgage Analytics Data; CoreLogic HPI.

© 2022 CoreLogic,Inc., All rights reserved.

Figure 1 shows that after a temporary decline and deviation from the pre-pandemic payment trends, monthly mortgage payments on home purchase loans rose quickly in the second half of 2020. This trend continued throughout 2021 as the pandemic housing market recovered at full speed and sent home prices soaring.

Recent homebuyers who financed their purchases using FHA loans — many of whom are likely first-time homebuyers — have seen a quick increase in their typical monthly payment despite the potential savings from record-low interest rates. In the second half of 2021, the typical monthly out-of-pocket cost for those using FHA financing reached $1,710, up $282 or 19.7% from the rates just prior to the onset of the pandemic.

Monthly payments on home purchases financed with VA loans showed a double-digit increase as well, rising $176, or 11.3% from pre-pandemic levels. In contrast, recent homebuyers who financed with conventional loans appeared to have captured significant interest savings, seeing monthly payment increases of only 3.3%, or $57 per month. Many of these homebuyers are likely repeat or trade-up buyers who were able to afford a large down payment to obtain a more favorable interest rate.[2]

First-time homebuyers often use FHA loans for financing lower-priced starter homes, and the surge in starter home prices has inadvertently eroded affordability and contributed to pricing out families who hope to become first-time homeowners.

Figure 2 shows home price appreciation rates during the same period. Appreciation rates are based on CoreLogic’s Home Price Index (HPI), and the trend line titled “HPI: All Sales” measures price growth using all home sales, including starter homes, while the trend line titled “HPI: Starter Homes” captures the growth for lower-priced starter properties only[3]. It is evident that soaring home prices have far outpaced any potential interest savings during the pandemic. Furthermore, the much faster appreciation of starter homes as compared to the overall market helps underscore the soaring cost of mortgage payments for recent homebuyers who used FHA or VA financing.

On an annual basis, rising monthly mortgage payments mean that those who bought a home in 2021 will pay an additional $3,379 per year if the home was financed with an FHA loan. Given a 30-year loan term, which is the most commonly used financing term, these homebuyers will pay an additional $101,400 over the next 30 years. For VA loans, this additional payment is $2,107 per year or $63,200 over the life of the loan, and for loans that are financed conventionally, this figure is $688 per year or $20,650 over 30 years.

Home prices continue to show

2022 CoreLogic, Inc. , All rights reserved.

[1] The non-P&I component as a percent of total monthly payment varies by source of financing. The median value of the non-P&I component is about 28% among conventional loans and 34% and 23-24% for FHA and VA loans, respectively. All FHA loans have mortgage insurance, which explains its larger non-P&I share. Among the non-P&Is, homeowners’ insurance or mortgage insurance is directly tied to the value of the home or loan amount, and rising home prices or larger loans means the costs associated with non-P&I tend to go up accordingly.

[2] It should be noted that several other factors that affect loan size or borrower affordability are not accounted for, including borrower income, loan-to-value ratio, debt-to-income (DTI) ratio and FICO score. The average borrower DTI inched higher and showed signs of slight deteriorations in affordability in 2021. Additionally, the average borrower FICO score rose slightly throughout the pandemic.

[3] Starter homes are those with a sale price threshold at or below 75% of local market’s median price.