Want unlimited access to top ideas and insights?

Two years of significant home price appreciation has resulted in national concerns about housing affordability. However, in new research by Freddie Mac, 6-in-10 individuals say they would consider purchasing the type of dwelling that has become the largest source of unsubsidized affordable housing in the United States: manufactured housing.

Construction costs for manufactured homes are typically lower, which may have contributed to their growing popularity in recent years. According to recent U.S. Census data,

A recent Freddie Mac housing survey shows that general familiarity with manufactured housing is relatively high, with 47% of respondents saying they are somewhat or very familiar with manufactured housing. In the study, 62% of people say they are likely to consider purchasing a manufactured home in the future.

Perception of Manufactured Homes

The overall perception of manufactured homes is positive, according to the survey results.

All told, 77% of people who are aware of manufactured homes expressed a positive sentiment toward these homes, describing them as “new,” “efficient,” “affordable” and “easy.” Most agree that there are tangible benefits to manufactured homes, including the following:

- Allow a wide range of customization.

- Affordable without compromising on quality.

- Ecofriendly and energy efficient.

- A good investment.

Who Is Likely to Consider Buying a Manufactured Home?

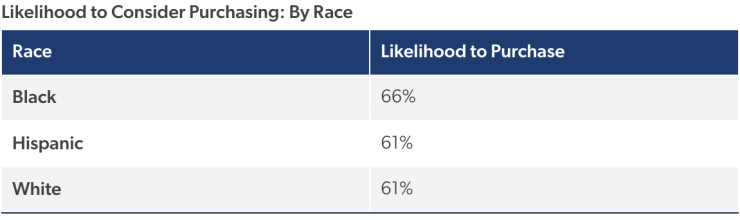

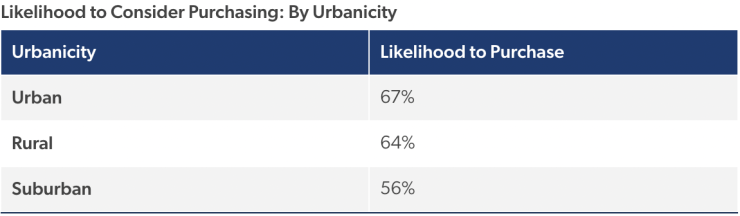

Although 62% of people say they are likely to consider purchasing a manufactured home in the future, certain populations are more likely than others to buy them. The survey results were analyzed by generation, race, urbanicity and household income to take a closer look at trends in likelihood to purchase a manufactured home.

Household income did not affect respondents’ reported likelihood to purchase, but the survey data shows that those with an annual income less than $50,000 have a significantly more positive perception of manufactured homes than the total sample or other income groups.

The 2022 Manufactured Housing Survey was fielded April 7-11, 2022, and includes responses from 2,092 respondents age 18 and older. The survey oversampled for Black and Hispanic consumers, Gen Z and Millennials.