-

With mortgage originations on the decline, lenders that want to regain lost volume or grow market share must work harder to identify and reach underserved borrower segments.

November 24 -

When data doesn't tell the whole story about untapped market opportunities, mortgage executives must draw on their personal experiences and local expertise to craft unique strategies to reach new borrowers.

November 24 -

Sometimes reaching underserved borrowers takes experimenting with changes to the mortgage finance system. That's why Fannie Mae and Freddie Mac are working with lenders to test innovative loan products that meet borrowers' evolving needs.

November 24 -

Continued economic growth, a strong jobs market and higher wages will lead to a 7.3% increase in purchase origination volume next year, according to the Mortgage Bankers Association.

October 24 -

Home equity lines could double over the next six years. Some banks are actively pursuing the consumer credit opportunity, whereas many still feel stung by the housing crisis, unimpressed by home equity’s comeback so far or fearful of nonbank competition and fraud.

October 30 -

Fannie Mae is staging more pilot projects with lenders and vendors, including one that consolidates submissions of different types of loan data potentially eligible for immediate representation and warranty relief.

October 23 -

Fannie Mae is testing a conforming loan product that makes use of a New Hampshire law that lets manufactured housing in resident-owned communities get treated like units in a co-operative building.

October 27 -

With online retailers beginning to challenge the dominance of brick-and-mortar grocery stores, CRE loans to strip mails anchored by them look riskier.

October 19 -

Some banks are looking at how to translate the complicated and document-heavy mortgage lending process into the digital world of voice-interactive personal assistants.

October 4 -

Quicken Loans Mortgage Services and Calyx Software developed a version of the Point loan origination system that's preconfigured with tools for small mortgage firms to work with the Detroit lender's TPO division.

October 11 -

Originators and real estate agents are considered more trustworthy and credible by home purchasers than online sources about mortgage information, a Fannie Mae study found.

October 19 -

The Senate's repeal of the Consumer Financial Protection Bureau rule is arguably the industry's biggest policy victory since passage of Dodd-Frank. But is it the sign of a trend?

October 25 -

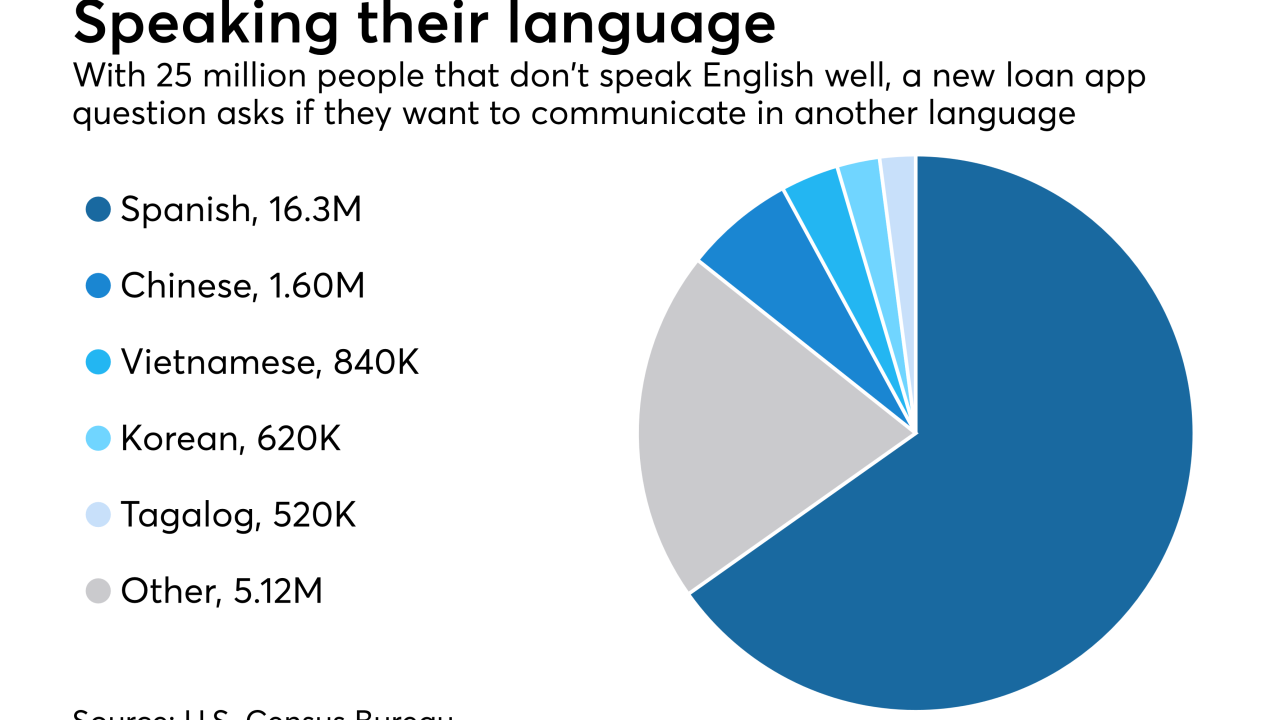

The Federal Housing Finance Agency added a language preference question to the loan application, rejecting the mortgage industry's wishes.

October 20 -

The Federal Housing Finance Agency's Duty to Serve program must increase manufactured housing lending in rural communities.

September 29 NeighborWorks America

NeighborWorks America -

Mortgage industry hiring and new job appointments for the week ending Nov. 10.

November 10 -

Here's a look at 12 cities where the median home sales price is below $215,000, but the combination of housing costs, local wages and other market forces is making home purchasing power disappear in these once-cheapest places to live.

October 5