-

Lending against single-family home construction is an area nonbanks have traditionally ceded to depositories. That's starting to change.

-

The mortgage industry is stepping up its fight against a bill that would raise the Department of Veterans Affairs' mortgage fees to cover medical costs for Vietnam vets.

April 1 -

The Federal Housing Finance Agency, by allowing Fannie Mae and Freddie Mac to split the CEO and president positions, let the companies dodge a congressionally mandated cap on executive salaries, the regulator's inspector general said.

March 27 -

The bank agreed to modify loans to struggling U.S. borrowers as part of a 2017 settlement. Instead, it’s receiving credit for financing new mortgages that likely would have been made anyway.

April 8 -

There's plenty credit unions can do to compete with the likes of Quicken Loans' Rocket Mortgage, but sources cautioned more than technology will be needed to boost the bottom line.

April 10 -

The mortgage industry is eager to adopt digital strategies like artificial intelligence to streamline processes, but they are finding it difficult to extend through the full lifecycle of the loan.

March 26 -

In her first policy speech since being confirmed as the agency's director, Kathy Kraninger promised less focus on enforcement actions and more emphasis on consumer education.

April 17 -

The Federal Housing Finance Agency is planning on finalizing its proposed capital requirements for the government-sponsored enterprises this summer, the agency's acting director said Wednesday.

March 28 -

Learning to understand the risk rather than adding steps to the mortgage application process is the way to mitigate fraud.

April 10 CoreLogic

CoreLogic -

As debate over the future of the mortgage finance system heats up, policymakers must ensure that small banks and credit unions maintain equitable access to the secondary market.

March 15

-

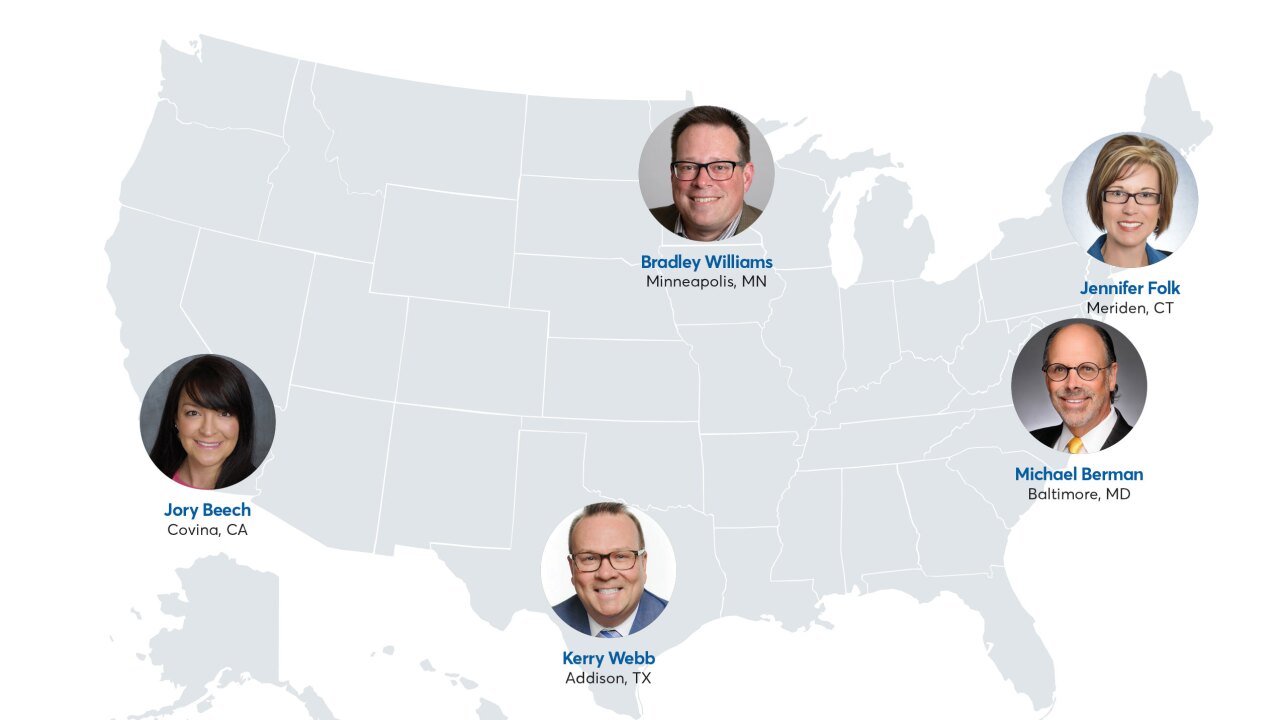

Mortgage industry hiring and new job appointments for the week ending May 3.

May 3 -

From the middle of the country to the Pacific Northwest, here's a look at cities where consumers wield the most purchasing power for the upcoming home buying season, based on changes in housing values compared to local wages and mortgage rates.

April 12