-

When big banks bailed on brokers during the housing crisis, United Wholesale Mortgage doubled down. As third-party originations now make a comeback, the family-owned company is determined to chip away at retail lenders' dominance.

July 13 -

United Wholesale Mortgage has set out to be an ally to mortgage brokers in unprecedented ways as CEO Mat Ishbia works to evolve the channel's transactional nature into a more relationship-driven dynamic.

July 13 -

To keep winning business in an increasingly competitive loan channel, United Wholesale Mortgage is giving brokers more control of the borrower relationships that persist even after loans close.

July 13 -

Maintenance and renovations aren't keeping up with the nation's aging housing stock, creating an influx of obsolete properties that's adding further strain to an already tight inventory of homes for sale.

June 15 -

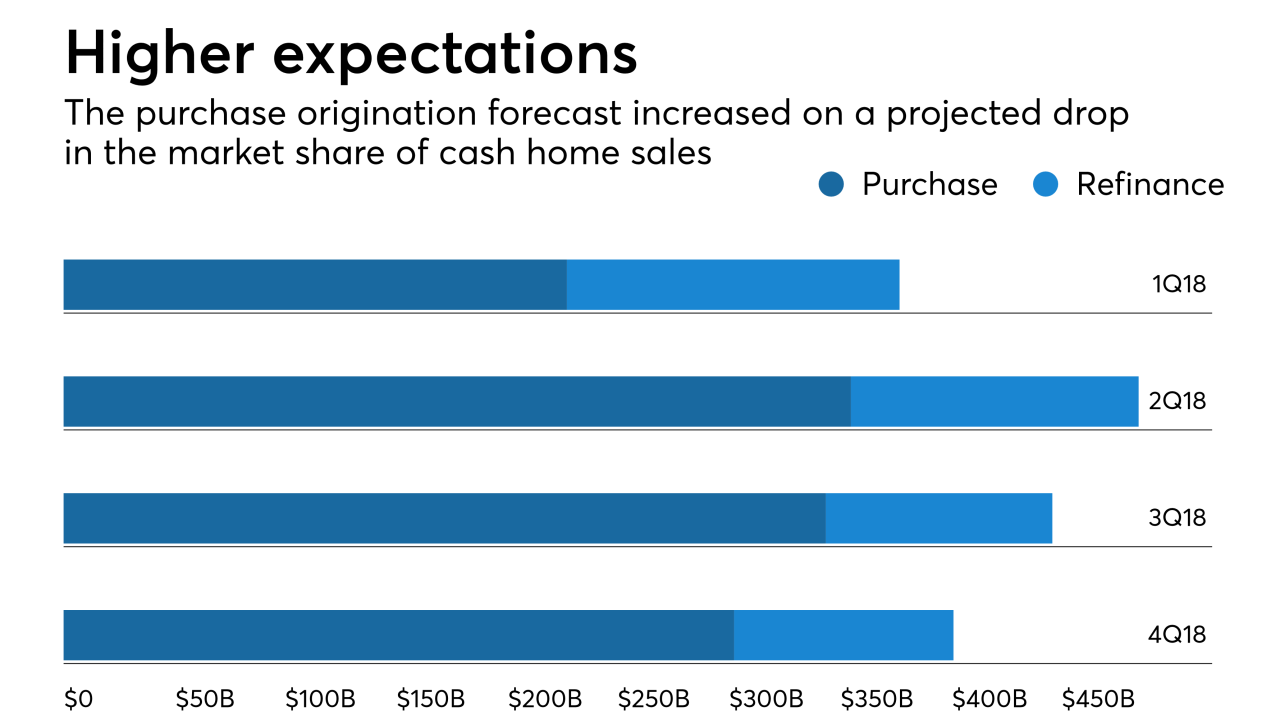

A declining share of cash home sales will drive purchase home originations higher than previously expected through 2019, according to Fannie Mae.

June 18 -

No plan will be implemented as long as Fannie Mae and Freddie Mac remain in conservatorship, but a capital framework for the companies could still have a substantive impact.

June 15 -

Fannie Mae is lowering down payment requirements and lender fees on manufactured housing loans to improve affordable housing access.

June 6 -

Citizens Bank's $511 million acquisition of Franklin American Mortgage will beef up the bank's servicing portfolio and diversify its origination business at a time when higher interest rates have put a damper on refinance volume.

May 31 -

Government-sponsored enterprises Fannie Mae and Freddie Mac are in a race to offer services and technology that help mortgage bankers raise cash from mortgage servicing rights.

May 23 -

The bill aimed at helping struggling homeowners also requires documentation of servicer behavior and FHFA evaluation of the services provided to borrowers.

June 18 -

A new integration between Blend and Ellie Mae seeks to improve the use and accessibility of electronic mortgage documents, the latest in an ongoing industry effort to create a more simplified and consistent borrower experience.

May 24 -

Reducing unnecessary compliance burdens will pave the way for economic growth, larger job creation and wage increases, and re-evaluating technology will play an important role in doing so, according to Craig Phillips, counselor to the secretary at the Department of the Treasury.

May 21 -

Courts have validated the legal theory behind punishing lenders for unintentional discrimination, but the Trump administration has shown interest in revising the Obama-era policy.

June 20 -

Federal law enforcement authorities have arrested 74 people in this country and abroad, accusing them of participating in a wire fraud scam whose victims included real estate attorneys and settlement service providers.

June 12 -

To make its technology more relevant to the mortgage industry, Fannie Mae is taking a new approach to developing tools that engages lenders earlier in the process and makes lending more efficient.

May 29 Fannie Mae

Fannie Mae -

Supporters say pending legislation would help consumers with little or no credit history. But the bill would instead roll back key consumer protections.

May 17 Pennsylvania Utility Law Project

Pennsylvania Utility Law Project -

Mortgage industry hiring and new job appointments for the week ending July 6.

July 6 -

From D.C. to Chicago, here's a look at the 12 cities where homebuyers are getting the best bang for their housing buck.

May 29