-

With compensation accounting for 80% of the cost to originate a mortgage, lenders are developing new strategies to attract and retain top talent, while keeping wage expenses in check.

January 29 -

Mortgage lead generation costs are notoriously variable and tough to control, especially when lenders are trying to save money with origination call centers.

January 29 -

From government grants to automating branch management tasks, lenders are using their knowledge of real estate, finance, and government incentives to maximize the resources they invest in facilities.

January 29 -

Warehouse lines of credit are getting more expensive as short-term interest rates rise, and lenders have limited options for reducing their costs.

January 29 -

Compliance is a significant cost center for mortgage lenders. But with bulk rates, technology and better process management, some lenders have found new ways to reduce the burden.

January 29 -

The Michigan company, which lost more than $1.4 billion in the aftermath of the financial crisis, is trying to become more of a commercial lender. Its recent agreement to buy a deposit-rich franchise in California could help it get there.

November 21 -

The vast majority of consumers with a home equity line of credit said they are considering using it to pay for planned home renovations this winter.

December 6 -

Until recently, there was a consensus among policymakers that Fannie Mae and Freddie Mac needed to be eliminated. That just changed. Here's why.

December 8 -

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4 -

The Federal Housing Administration's recent actuarial report has added more fuel to the fire over concerns about reverse mortgages, including their effect on the overall FHA insurance fund and a rise in foreclosures.

November 22 -

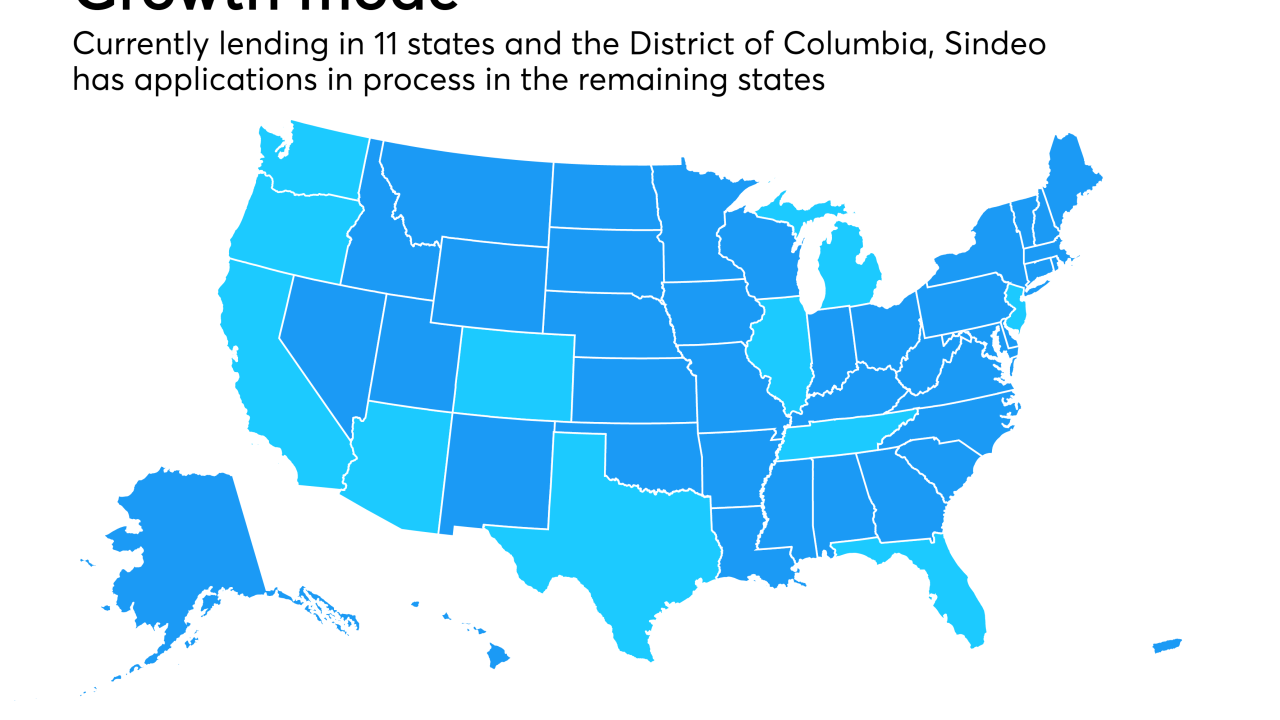

When a $40 million round of venture funding fell through at the last minute, digital mortgage broker Sindeo all but shut down this summer. Now recapitalized and rejuvenated, founder and CEO Nick Stamos explains why Sindeo is ready to grow again.

November 21 -

Consumer credit bureau and data aggregator Experian will gain a foothold in the U.K. mortgage market by acquiring a minority stake in mortgage brokerage London & Country Mortgages Limited.

December 11 -

The ill will between Democrats and Republicans in the controversy over appointing an acting Consumer Financial Protection Bureau chief adds a new wrinkle to bipartisan efforts to pass regulatory relief.

December 1 -

Employees at the Consumer Financial Protection Bureau are privately questioning why outgoing director Richard Cordray abruptly tapped a 34-year-old chief of staff with no enforcement, supervisory or legal experience to head the embattled agency after he resigned.

November 28 -

Mortgage servicers should be especially concerned by the rise in Telephone Consumer Protection Act lawsuits, which often hinge on whether consent to call borrowers exists or has been revoked.

November 30 Balch & Bingham

Balch & Bingham -

Potential first-time home buyers can save money for a down payment if they are able to use a special account just for that purpose.

November 17 Bilt Rewards

Bilt Rewards -

Mortgage industry hiring and new job appointments for the week ending Jan. 12.

January 12 -

Here's a look at 10 housing markets where limited competition, lower prices and plentiful inventory give buyers the upper hand in home sales transactions.

January 10