-

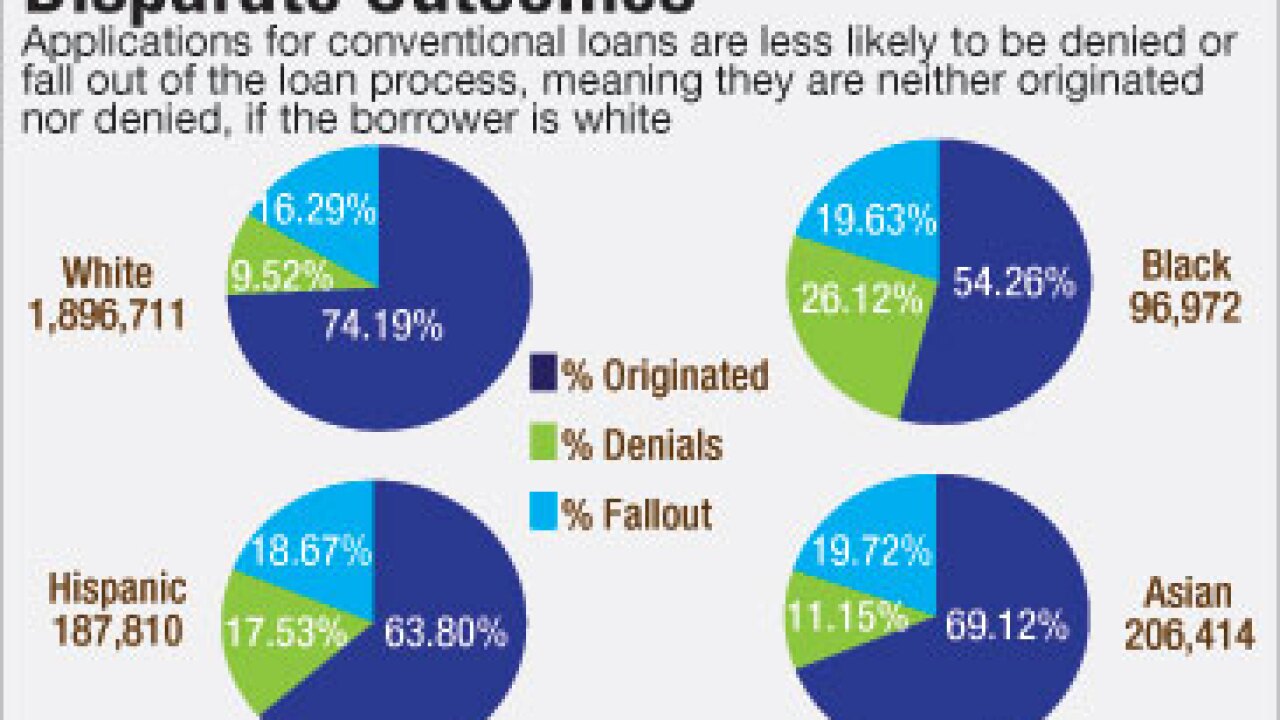

Demographics are shifting, creating more prospective minority homebuyers than ever before. But predominant underwriting processes and these would-be borrowers' financial backgrounds are holding them back.

January 5 -

Initiatives aimed at a more inclusive credit box have long relied on costly approaches that are difficult to scale. Now, demographic shifts are intensifying industry demand for a more automated and efficient solution.

January 6 -

Regulators have pressed banks to watch out for rising concentrations of commercial real estate loans. Some banks have paid heed, but others are skyrocketing past recommended thresholds.

November 3 -

PHH Corp. has agreed to pay a $28 million fine to the New York Department of Financial Services to settle allegations its servicing and origination units mistreated borrowers.

November 9 -

A new refinance mortgage offered by SoFi and Fannie Mae lets consumers tap into their home equity to pay down student loan debt at terms more favorable than a traditional cash-out refi.

November 2 -

Since the government-sponsored enterprises began experimenting with both frontend and backend deals in which part of the credit risk is shared with third parties, investors have been watching carefully.

November 4 -

A post-crisis spike in foreclosures, the Deepwater Horizon oil spill and recent flooding in Louisiana all shaped the terms and timing of a bank deal struck in Florida.

November 7 -

Banks have been waiting on Justice Department guidelines on how to make their websites compliant with the Americans with Disabilities Act, but many are being advised to take action now or face lawsuits from disabled customers.

November 10 -

Housing was the talk of the campaign two presidential elections ago, but it stayed under the radar in the 2016 race, leaving plenty of room to speculate about President-elect Donald Trump's likely mortgage policy for the next four years.

November 9 -

President-elect Donald Trump might attempt to remove Consumer Financial Protection Bureau Director Richard Cordray from his post and boost legislative efforts to weaken its powers.

November 9 -

Can some of the top names in mortgage lending outdo online lending startups in head-to-head competition? We're about to find out. Wells Fargo, Quicken Loans and SunTrust have all entered the digital lending business, putting early entrants on the defensive.

November 1 -

The president-elect faces major questions about credit access, affordable housing, the future of Dodd-Frank and the structure of the Consumer Financial Protection Bureau and the extent to which he will act upon them remains unclear.

November 10 Community Home Lenders of America

Community Home Lenders of America -

Condominium associations cannot afford to take on the potential legal risk that reporting delinquent borrowers to the credit bureaus would bring.

October 13 Marcus, Errico, Emmer & Brooks

Marcus, Errico, Emmer & Brooks -

Mortgage industry hiring and new job appointments for the week ending Nov. 11.

November 11 -

A simple rhyme reminds one loan officer in a bustling California housing market to stay focused, committed and to treat every loan equally.

October 21 -

Courting borrowers with past bankruptcies might not cross most loan officers' minds as the best strategy for building business, but Guaranteed Rate's Danielle Young doesn't let borrowers' past blemishes intimidate her.

November 1 -

After nearly eight years of record-low mortgage rates and booming refinance volume, many signs indicate the run is winding down. Here's a look at 10 steps lenders should take now to stay profitable when rates rise and purchase loans drive the market.

November 7