-

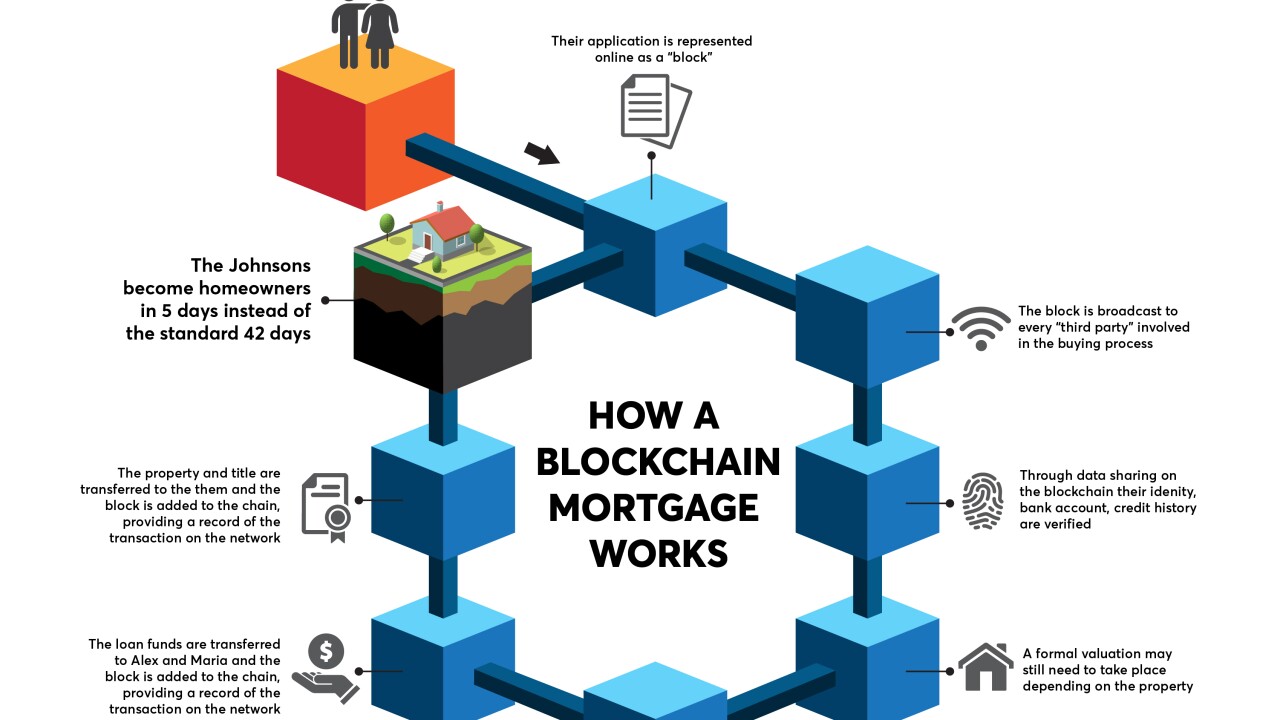

Blockchain technology can support a number of core technology issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

April 16 -

Blockchain technology promises to streamline how mortgages are managed at every point in their life cycle. But it will take an industrywide embrace for blockchains to reach their full potential.

April 18 -

The Hispanic homeownership rate grew for the third straight year in 2017 and the number of homeowners in the demographic group is at an all-time high, despite ongoing concerns about immigration policy and the shortage of homes for sale.

February 27 -

After narrowing its search to 20 cities, housing experts predict Amazon will choose Atlanta or Northern Virginia as its second headquarters, which will have a profound impact on both housing and the economy in and around the chosen city.

March 2 -

House flipping activity is at an 11-year high, prompting lending for these projects to soar 27%, according to Attom Data Solutions. And with most flippers still using cash, the trend has room to grow.

March 8 -

The success of the government-sponsored enterprises' credit risk transfer programs shows that they can be the basis for housing finance reform.

March 7 -

Acting commissioner Dana Wade said the agency is "vigilantly" watching whether it needs to take action on PACE assessments placed on mortgages after they are endorsed by the agency.

February 27 -

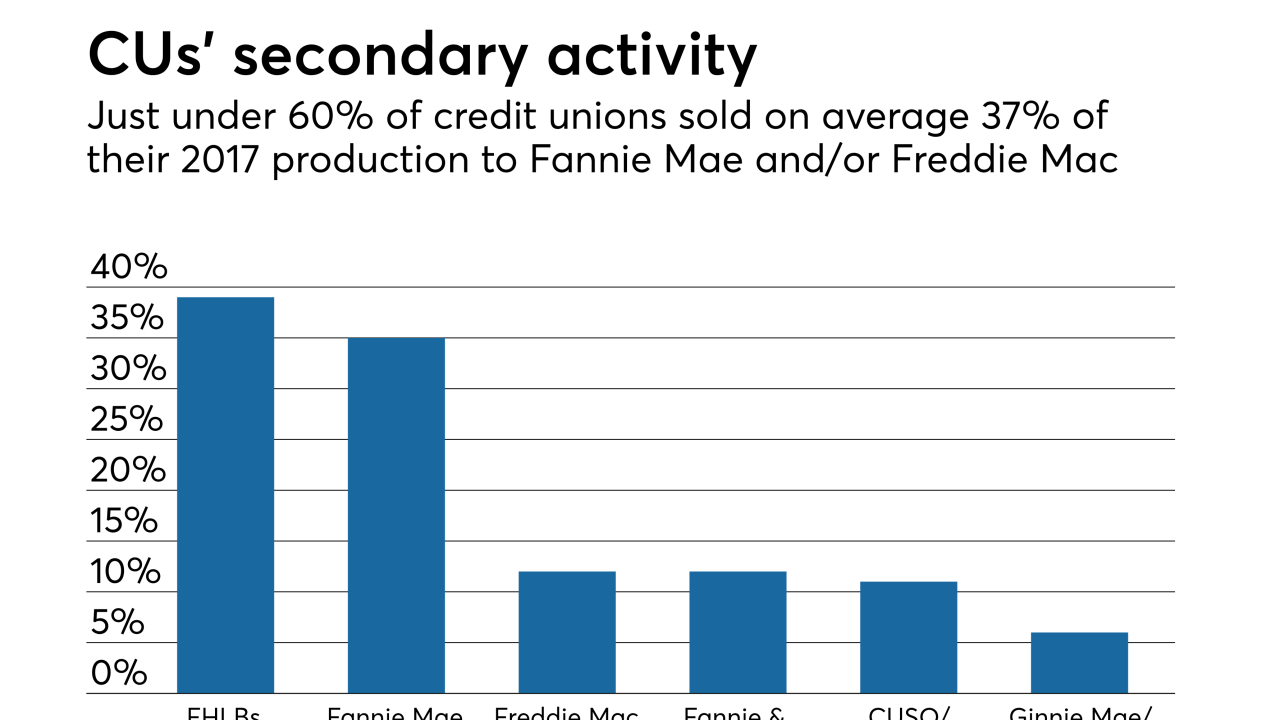

Credit unions favor housing finance reforms that would keep the government-sponsored enterprises or something similar in place, but add an explicit government guarantee to their mortgage-backed securities, according to a recent survey.

February 26 -

With few foreclosed homes left to pick up on the cheap, the biggest landlords are buying, or building, new single-family homes to pad their portfolios; mortgages on these properties could show up as collateral in rental bonds.

February 14 -

The bank will spend an additional $1.4 billion on technology in 2018 to gain share and boost efficiency, executives said Tuesday. But they were peppered with questions about whether the big investment will yield a big financial return down the road.

February 27 -

To attract new customers, banks are getting rid of the paper-based payments process between builders and subcontractors.

March 2 -

The acting head of the Consumer Financial Protection Bureau has made clear he wants to rein in the bureau’s spending, but what exactly he plans to cut is a mystery.

February 28 -

The Trump administration's new tariffs on imported steel and aluminum may raise prices on a variety of consumer and commercial products, but will only put minimal strain on the housing industry.

March 9 -

From origination to payoff, blockchain technology makes data more reliable and secure to enhance and improve mortgage lending.

February 23 Fiserv

Fiserv -

The legislation carves out protections for smaller banks to offer abusive loans to borrowers under the "qualified mortgage" standard, as long as they hold those loans in portfolio.

March 1 Boston College

Boston College -

Mortgage industry hiring and new job appointments for the week ending April 6.

April 6 -

Here's a look at the 10 housing markets with the biggest gap between growth in home prices and wages that could indicate a housing bubble is forming.

February 13